App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

App herunterladen

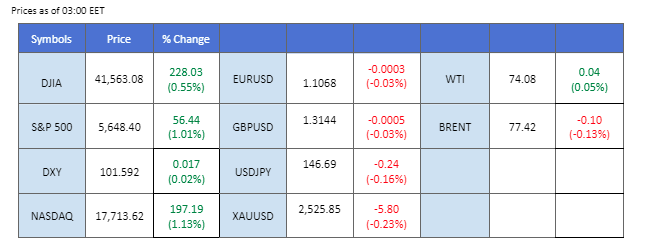

Market Summary

Oil prices rebounded above the critical support level near the $73.00 mark, driven by several key factors. Libya’s key oil field shutdowns have led to a reduction of a million barrels in global daily oil supplies, significantly pushing oil prices higher in the last session. Additionally, the U.S. government is set to impose new sanctions on Venezuela, which could further disrupt oil supplies. Furthermore, tensions escalated in the Middle East after Yemen’s Houthis attacked two crude oil tankers in the Red Sea, adding to the upward pressure on oil prices.

In the forex market, the dollar has been strengthening since the beginning of the week. Traders are now closely watching today’s U.S. PMI reading to assess the strength of the U.S. dollar. Tomorrow’s Austrian GDP release and the Bank of Canada’s interest rate decision could also impact the respective currencies. Meanwhile, with the prospect of a Fed rate cut, Wall Street is trading with increased optimism, and risk appetite has been improving as the Fed’s interest rate decision date approaches.

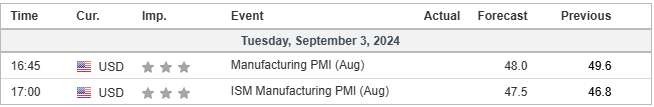

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (32.5%) VS -25 bps (67.5%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index remained flat due to the US holiday, keeping market activity subdued. Expectations for the US economic outlook have shifted slightly after better-than-expected GDP reports, suggesting the Fed may have room to moderate its policy easing. Despite this, most traders still anticipate a rate cut, with a 33% chance of a 50 basis points reduction this month and a 64% likelihood of a 25 basis points cut. The upcoming jobs report will be crucial in determining the trend for the US Dollar.

The Dollar Index is trading flat while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 64, suggesting the index might enter overbought territory.

Resistance level: 102.35, 103.35

Support level: 101.55, 100.55

Gold prices tumbled, primarily due to a technical breakout after falling below a crucial support level. The unexpectedly strong performance in the US economy has added to the uncertainty, leading some investors to sell off gold and take profits while adopting a wait-and-see approach. Key economic indicators this week, including Nonfarm Payrolls and the US Unemployment Rate, will be critical in shaping the future movement of gold prices.

Gold prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 2505.00, 2525.00

Support level: 2480.00, 2450.00

The GBP/USD pair remains under pressure, trading below its critical liquidity zone near the 1.3150 mark, indicating a bearish signal for the pair. With the Pound Sterling lacking a clear catalyst, traders are focusing on today’s U.S. PMI reading to gauge the strength of the dollar and its potential impact on the pair’s price movement. A stronger-than-expected PMI could further bolster the dollar, pushing the GBP/USD pair lower and vice versa.

GBP/USD has been trading in a downtrend pattern after the pair formed a bearish divergence with the MACD. The MACD is now breaking below the zero line, while the RSI is currently flowing below the 50 level, suggesting the pair is trading with bearish momentum.

Resistance level: 1.3220, 1.3280

Support level: 1.3065, 1.2980

The Euro extended its losses amid rising expectations for a rate cut by the European Central Bank (ECB). Policymakers are almost certain to ease again in September, with the Bank of France’s Governor, François Villeroy de Galhau, calling for further rate reductions to address slowing price growth.

EUR/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bullish momentum, while RSI is at 42, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1.1115, 1.1190

Support level: 1.1020, 1.0920

The USD/CAD pair has been trending upward recently, driven by the strengthening U.S. dollar. The Bank of Canada (BoC) is scheduled to announce its interest rate decision next week, with market expectations leaning towards a 25 basis point rate cut. If the BoC meets these expectations, it could further weaken the Canadian dollar, potentially allowing the USD/CAD pair to continue its ascent.

The pair is moving upward but may face strong selling pressure when it approaches the fair value gap at above 1.3530. The MACD is on the brink of breaking above the zero line, while the RSI has been rising, suggesting that the bullish momentum is gaining with the pair.

Resistance level: 1.3520, 1.3610

Support level:1.3435, 1.3360

The AUD/USD pair is facing strong selling pressure above the 0.6800 level, indicating a lack of bullish momentum and a potential start to a retracement. Traders are closely watching for tomorrow’s Australian GDP release, which could serve as a crucial economic indicator for assessing the strength of the Aussie dollar. In addition, today’s U.S. PMI reading is expected to be a key factor influencing the pair’s price action, as it could impact market sentiment and the perceived strength of the U.S. dollar. Both events are likely to contribute to increased volatility for the AUD/USD pair in the near term.

The pair is approaching its key support level at near 0.6740. If the pair fails to rebound from this level, it may be a solid bearish signal. The RSI has dropped to below 50, while the MACD has formed a bearish divergence, suggesting the pair may have a bearish trend reversal.

Resistance level: 0.6845, 0.6920

Support level: 0.6730, 0.6670

Oil prices rebounded slightly due to technical correction, though the overall trend remains bearish. Recent bearish momentum in the oil market has been driven by concerns over a potential slowdown in demand from China, while OPEC+ plans to continue its scheduled output increases starting in October. However, losses have been limited by halting production at Libyan ports, though analysts suggest the impact may be minimal.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 47, suggesting the commodity might extend its gains after breakout since the RSI rebounded sharply from oversold territory.

Resistance level: 74.30, 77.45

Support level: 71.80, 67.50

Traden Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Tradingbedingungen

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!