App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

App herunterladen

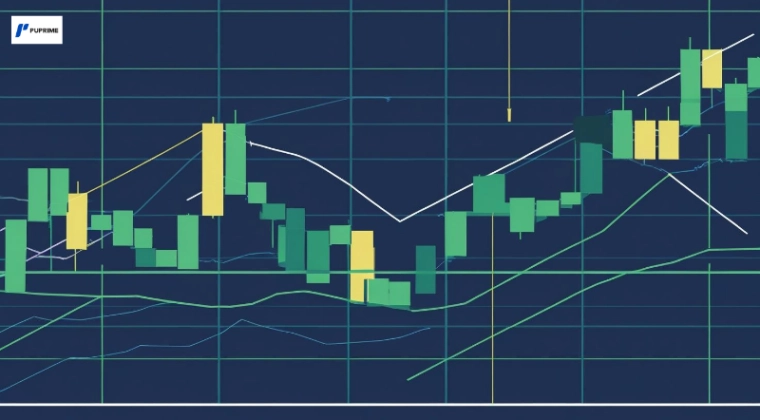

If you’re learning to read price charts, you’ll come across a range of patterns that traders use to spot possible moves in the market.

One of those is the bear flag pattern.

A bear flag pattern often appears after a sharp drop in price.

The market pauses and moves slightly upward or sideways, forming a small channel, which is known as the “flag.”

If the price breaks lower again, it may indicate that the downtrend is continuing.

This pattern matters because it helps traders recognise when a sell-off might have more room to run.

It’s not a guarantee, but it’s one of the common tools traders use to understand what’s happening in the market.

In this article, we’ll walk through what a bear flag looks like, how to spot it on a chart, what to watch for before trading it, and how it’s different from a bull flag, which signals the opposite move.

Whether you’re trading shares, forex, or crypto, learning how to read patterns like this can help you build more confidence in your decisions.

A bear flag pattern is a type of chart formation that traders watch for during a downtrend.

It’s called a “flag” because it looks like one when drawn on a price chart.

The pattern has two main parts:

This whole structure forms a bear flag. Traders watch for a break below the flag to suggest that the next leg down might be starting.

The bear flag is part of a broader group of chart patterns that traders use to study price action.

It’s known as a continuation pattern, which means it usually signals that the market will keep moving in the same direction it was going before (down, in this case).

To recognise a bear flag pattern, it helps to understand the typical signs that show up on a price chart.

These patterns follow a familiar shape that traders look for, especially during a downtrend.

Here’s what a bear flag usually looks like:

If you’re looking for a bear flag on a price chart, the key is spotting the right shape and structure within an existing downtrend.

Here’s how to break it down step by step.

1. Start with the Flagpole

Look for a sharp drop in price – this is the flagpole. It’s usually one of the fastest and steepest moves on the chart, showing strong selling pressure. The bigger and clearer this drop is, the stronger the pattern tends to be.

2. Spot the Flag

Next, check if the price starts moving sideways or slightly higher in a tight channel. This is the flag. It should be smaller than the flagpole and form between two parallel trend lines that slope upward or stay mostly flat.

3. Draw Your Trendlines

Once you see the flag forming, draw two parallel lines – one across the recent highs, one across the lows. This helps you visualise the flag’s boundaries.

The flag should stay within this range until a breakout happens.

4. Look at the Volume

During the flag phase, volume often drops. This signals a slowdown in momentum.

If volume starts to rise again as price breaks below the flag, it can help confirm the breakout.

5. Check the Trend and Timeframe

Bear flags are more reliable when they appear during a clear downtrend.

They can show up on any timeframe, but patterns on 1-hour charts and above tend to be stronger than those on very short-term timeframes.

Once you’ve spotted a bear flag and confirmed it with volume and trend direction, you’re in a better position to plan a possible trade.

Spotting a bear flag is just the first step.

Before acting on the pattern, traders usually look for confirmation, which are extra signals that help show the breakout is more likely to hold.

This is where technical indicators come in.

You don’t need to use every tool at once, but using more than one signal can give you more confidence in your decision.

Here are a few ways traders confirm a bear flag:

1. Moving Average Cross

If a short-term moving average (like the 9 or 20 EMA) crosses below a longer-term one (like the 50 EMA), it can help confirm that the trend is still heading lower.

This adds strength to the bearish signal when the flag breaks down.

2. RSI Weakness

The Relative Strength Index (RSI) measures momentum. If RSI is below 50 and turning lower – or showing what’s called a failure swing (when it tries to rise but fails) – that can suggest the sellers are still in control.

3. MACD Histogram Rollover

The MACD histogram tracks the difference between two moving averages.

If the histogram moves from positive to negative during the flag phase, or starts to roll over as price nears the breakout, it can add support to the bearish view.

4. Volume Spike on Breakout

This is a big one. A volume spike when price breaks below the flag often signals that the breakout has real momentum behind it.

Without increased volume, there’s a higher risk of a false breakout.

No pattern works 100% of the time.

Confirmation helps reduce the chance of being caught in a false move.

The more signals that line up (trend direction, price structure, volume, and indicators), the stronger the setup tends to be.

Once a bear flag has formed and you’ve confirmed the setup, the next step is figuring out how to trade it.

While approaches can vary, most traders focus on a few key steps: where to enter, where to place a stop, and how to set a realistic target.

Most traders wait for the price to break below the lower trendline of the flag before entering.

A sell-stop order just below that line can help catch the breakout as it happens.

This avoids jumping in too early, before the pattern is confirmed.

A common place for a protective stop-loss is just above the recent high of the flag.

If price reverses and climbs back into the pattern, it’s often a sign the setup has failed.

The stop helps limit losses if that happens.

To set a price target, traders often use the height of the flagpole (the first sharp drop before the flag formed).

They take that distance and project it downward from the breakout point.

This gives a rough idea of how far the move could go.

Before entering any trade, it’s important to check the risk/reward ratio.

Many traders look for at least a 2:1 ratio, meaning the potential reward is twice the size of the risk.

This helps you stay profitable over time, even if some trades don’t work out.

Other techniques include:

Trading a bear flag isn’t just about spotting the pattern.

You need to plan your trade clearly and protect your capital.

Even when a bear flag looks chart-perfect, it can still lead you the wrong way.

Like any setup, it’s not foolproof.

Knowing where traders often go wrong may help you avoid costly errors.

One of the most common mistakes is jumping in before the breakout actually happens.

The price might be hovering near the bottom of the flag, and it feels like it’s about to break, but until it closes below support, it’s not confirmed.

Acting too soon can leave you stuck in a position that goes nowhere.

Bear flags can look different on each chart.

If you draw the trend lines too loosely or force a pattern that isn’t really there, you might enter trades based on a setup that doesn’t meet the criteria.

Make sure the flag has a clear drop, a tight upward or sideways channel, and a few solid touches on support and resistance.

Bear flags work best when they show up during a strong downtrend.

If the overall market is choppy or starting to reverse upward, the pattern is more likely to fail.

Always check the broader trend before relying on the flag by itself.

A false breakout happens when the price dips below the flag, triggers entries, and then quickly snaps back above support. It’s frustrating, but it’s part of trading.

That’s why confirmation and risk management matter so much.

Tools like volume spikes or indicator support can help filter out weaker breakouts.

To limit damage from a failed setup:

By staying patient, drawing the pattern properly, and sticking to a clear risk plan, you’ll be better placed to use bear flags effectively, without falling for a signal that looks promising.

Let’s bring everything together with a few real-world examples of the bear flag pattern.

Seeing it on a chart is often the best way to understand how the setup forms, how traders confirm it, and what a trade might look like from start to finish.

These examples walk through the whole sequence, from spotting the flag to planning the trade to managing the outcome.

Bull and bear flags are closely related as they’re both continuation patterns.

The main difference is the direction in which the market is moving.

A bull flag appears in an uptrend and suggests the price may continue higher.

A bear flag appears in a downtrend, hinting that the decline could resume.

They look similar on the chart, but they mirror each other in terms of price direction and trading approach.

Here’s a quick side-by-side comparison:

| Feature | Bull Flag | Bear Flag |

| Trend Direction | Uptrend | Downtrend |

| Flagpole | Strong price rise | Sharp price drop |

| Flag Shape | Slopes downward or moves sideways | Slopes upward or moves sideways |

| Market Psychology | Buyers take a breather before pushing up | Sellers pause before driving price lower |

| Entry Trigger | Break above upper flag boundary | Break below lower flag boundary |

| Target Projection | Measure height of flagpole, project up | Measure height of flagpole, project down |

| Common Use | Spotting bullish momentum | Spotting bearish continuation |

Both patterns rely on the same basic logic: after a strong move, the market pauses and then potentially continues in the same direction.

The key is identifying the trend and watching for confirmation before taking action.

Understanding the bear flag pattern gives traders a helpful tool for spotting when a downtrend might keep going.

While we can’t predict the future perfectly, we can recognise common behaviour in the market and prepare for what might come next.

The pattern itself is simple once you know what to look for, but like any setup, it works best when paired with patience, confirmation, and smart risk management.

If you’re still getting the hang of it, try practising on demo charts first.

Platforms like PU Prime let you explore live markets and test your strategies using CFDs, all without putting your capital at risk.

Want to put what you’ve learned into practice?

PU Prime gives you access to a wide range of markets through CFDs, including indices, forex, and more.

You can test spotting patterns like the bear flag pattern in a risk-free demo environment or explore real-time setups with flexible trading tools.

Head to PU Prime to learn more and see how the platform works for you.

Traden Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Tradingbedingungen

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!