App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

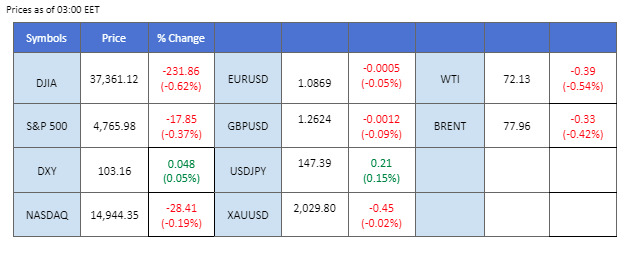

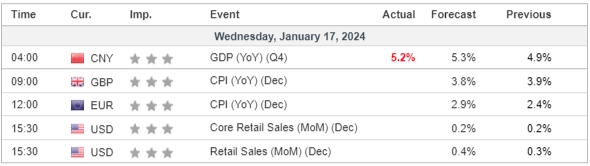

Despite a relatively dovish speech from Fed governor Christopher Waller, the U.S. dollar maintained its upward trajectory, putting pressure on both gold and equity markets. Wall Street faced selling pressure as early bets on Fed rate cuts diminished. Gold prices experienced their most significant daily decline of 1.28% in 2024, primarily attributed to the strengthened dollar. Meanwhile, oil prices edged lower, with market participants awaiting Chinese GDP data. The data fell slightly short of expectations, failing to provide the anticipated boost to oil prices. Traders are closely monitoring upcoming UK and Eurozone CPI readings, anticipating potential impacts on the Sterling and Euro.

Aktuelle Wetten auf eine Zinserhöhung 31. Januar Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

(MT4 Systemzeit)

Quelle: MQL5

Marktbewegungen

DOLLAR_INDX, H4

The Dollar Index sees an extension of its upward trajectory, finding support in surging US Treasury yields as expectations for a March rate cut from the Federal Reserve diminish. Christopher Waller’s recent hawkish remarks, emphasizing the proximity to the Fed’s 2% inflation target, prompt market participants to recalibrate their outlook. As Waller cautions against hasty rate cuts in response to improved inflation figures, the US Dollar experiences renewed demand.

The Dollar Index is trading higher following the prior breakout above the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the index might experience technical correction since the RSI had entered overbought territory.

Resistance level: 103.50, 104.40

Support level: 102.60, 101.90

Despite rising geopolitical tensions in the Middle East sparking a risk-off sentiment, gold prices face headwinds, primarily from the strengthening US Dollar. The hawkish statements from Fed’s Waller, coupled with an uptick in US Treasury yields, contribute to the dollar’s ascent, weighing down on the appeal of dollar-denominated gold. The complex interplay between geopolitical events and currency dynamics underscores the nuanced environment for gold investors.

Gold prices are trading lower following the prior breakout below the support level. MACD has illustrated increasing bearish momentum, while RSI is at 42, suggesting the commodity might extend its losses since the RSI stays below the midline.

Widerstandsniveau: 2035,00, 2055,00

Unterstützungsniveau: 2015,00, 1985,00

The Pound Sterling is encountering challenges as the U.S. dollar maintains its momentum, driven by shifting market sentiment. Despite a dovish narrative in the Fed Governor’s recent speech, expectations for an early Fed rate cut continue diminishing, bolstering the dollar’s strength. Traders eagerly await the UK’s CPI reading later today, seeking insights into Sterling’s performance amid the evolving global market dynamics.

GBP/USD declined significantly as the dollar continued to strengthen. The pair is currently supported by its near support level at 1.2631; a break below suggests a strong bearish bias for the pair. The RSI is on the brink of breaking into the oversold zone while the MACD continues to diverge at below zero line, suggesting the bearish momentum is strong.

Widerstandsniveau: 1,2729, 1,2815

Unterstützungsniveau: 1,2630, 1,2528

The EUR/USD pair faced downward pressure as the U.S. dollar extended its strength, prompted by remarks from Fed Governor Christopher Waller. Waller emphasised the need for caution regarding a rate cut, stating that while possible, it requires careful consideration. This tempered market expectations for an early rate cut in 2024, subsequently boosting the dollar.

The EUR/USD pair is currently supported at near the 1.0866 level while the bearish momentum remains strong. The RSI is on the brink of breaking into the oversold zone, while the MACD has broken below the zero line and started to diverge, suggesting the bearish momentum is strong.

Widerstandsniveau: 1,0954, 1,1041

Unterstützungsniveau: 1,0866, 1,0775

The USD/JPY pair continues its upward trajectory as the U.S. dollar maintains its robust performance, propelled by positive economic indicators. The Japanese Yen faces challenges amid dovish market expectations for the Bank of Japan (BoJ). Upbeat U.S. economic data has led to reduced expectations of an early Fed rate cut, contrasting with Japan’s struggle to achieve inflation targets. This contributes to speculation that the BoJ may delay its monetary policy shift. Investors are eagerly awaiting the release of U.S. retail sales data later today, which is poised to influence the strength of the dollar.

USD/JPY traded to its one-month high level and has broken multiple resistance levels, suggesting the bullish momentum remains strong. The RSI has broken into the overbought zone while the MACD rebounded from above the zero line, suggesting the bullish momentum has picked up.

Resistance level: 148.77, 151.83

Unterstützungsniveau: 145,35, 143,80

The US equity market edges lower following mixed earnings reports from banking giants Morgan Stanley and Goldman Sachs, placing pressure on the financial sector. Concurrently, rising US Treasury yields, driven by heightened expectations of a high-interest-rate environment, weigh on overall market sentiment. Boeing’s significant slump, triggered by the FAA’s indefinite extension of the grounding of its 737 Max 9 aeroplanes, adds to the challenges faced by the market.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 57, suggesting the index might extend its losses toward support level since the RSI retrated sharply from overbought territory.

Widerstandsniveau: 37850,00, 39275,00

Unterstützungsniveau: 36735,00, 35950,00

Oil prices stabilize amidst a tug-of-war between a surging US Dollar and concerns over China’s economic outlook. Pessimistic signals from China, a major global oil importer, pose a threat to oil demand. Investors closely monitor economic data, including China’s GDP, for insights. Escalating tensions in the Middle East provide a counterbalance, limiting losses. The latest US military strike in Yemen adds to the geopolitical complexity influencing oil market dynamics.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 45, suggetting the commodity might extend its losses since the RSI stays below the midline.

Widerstandsniveau: 74,00, 78,65

Unterstützungsniveau: 70,25, 67,40

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!