App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

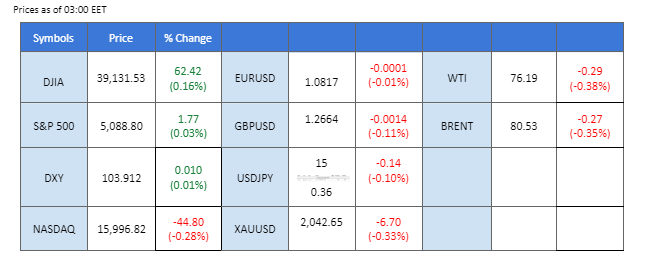

The robust U.S. stock markets, having reached record highs, paused for breath last Friday, reflecting a momentary halt in their bullish momentum.

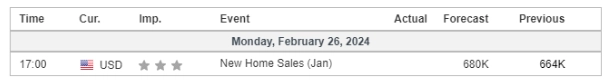

The robust U.S. stock markets, having reached record highs, paused for breath last Friday, reflecting a momentary halt in their bullish momentum. Conversely, the dollar index has maintained a subdued trajectory in recent sessions, but this calm is anticipated to be disrupted in the week ahead. The spotlight is on the upcoming release of the Federal Reserve’s preferred inflation gauge, the PCE reading, scheduled for Thursday. Additionally, the week will feature appearances from numerous Fed officials, with their remarks expected to provide insight into the central bank’s future monetary policy direction and consequently impact the dollar’s strength.

In contrast, the Japanese Yen, which has softened recently, faces challenges this week as the National Core CPI reading is slated for release tomorrow. Market observers keenly await this data, which needs to exceed market expectations to potentially bolster the weakened Yen.

Turning to commodities, gold prices have found support above the $2030 mark and remain sensitive to movements in the dollar’s strength. Conversely, oil prices witnessed a sharp decline of over 2.20% last Friday, reflecting concerns surrounding sluggish demand and increasing supply in the market.

Aktuelle Wetten auf eine Zinserhöhung 20. März Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (89,5%) VS -25 bps (10,5%)

(MT4 Systemzeit)

Quelle: MQL5

The US Dollar remains range bound as market participants anticipate a potential delay in Federal Reserve rate cut decisions. The recalibration of rate cut expectations, now at 80 basis points compared to earlier projections of 150 basis points for early 2024, follows strong economic indicators, including the Consumer Prices Index (CPI), Producer Prices Index (PPI), and employment reports.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 48, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Widerstandsniveau: 104,60, 105,70

Unterstützungsniveau: 103,85, 103,05

Gold prices experience a slight retreat in early Asian trading, influenced by climbing US Treasury yields and the expectation of delayed Fed rate cuts. Uncertainties surrounding the Fed’s interest rate timeline prompt a wait-and-see approach, with investors closely monitoring the Core Personal Consumption Expenditures Price Index (PCE) on Thursday for potential trading signals. Despite the pressure, gold finds support from rising Middle East tensions, mitigating potential losses in the precious metal market.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 58, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Widerstandsniveau: 2035,00, 2060,00

Support level: 2015.00, 1985.0

Throughout the past week, the GBP/USD pair has exhibited an upward trend within a channel, with the U.S. dollar encountering persistent headwinds. The upcoming U.S. PCE index release and comments from Federal Reserve officials are poised to play a pivotal role in shaping expectations regarding future monetary policy decisions. These events are likely to influence the strength of the dollar. The Cable is anticipated to sustain its position above 1.2635 levels, enabling it to persist within the established uptrend channel.

GBP/USD remain trading in its uptrend channel, suggesting a bullish bias for the pair. The RSI remain in the upper region while the MACD has been moving up, suggesting the bullish momentum remains strong.

Widerstandsniveau: 1,2710, 1,2785

Unterstützungsniveau:1,2635, 1,2530

Over the past week, the EUR/USD pair has experienced a climb of more than 1%, though the bullish momentum exhibited a slight deceleration in the last session. The release of the Federal Open Market Committee (FOMC) meeting minutes last week hinted that U.S. interest rates might have reached their zenith. In contrast, officials from the European Central Bank (ECB) have yet to deliberate on the timing of the initial rate cut. This divergence in monetary policy stance has injected bullish momentum into the currency pair, influencing its upward trajectory.

EUR/USD has eased from its bullish trend and is about to form a “Head-and-Shoulders” price pattern, suggesting a trend reversal for the pair. The MACD gradually moves downward while the RSI declines from near the overbought zone, suggesting the bullish momentum is easing.

Widerstandsniveau: 1,0865, 1,0954

Unterstützungsniveau: 1,0775, 1,0770

Die US equity market shows limited movement after a record-high run, with the AI-fueled tech sector rally displaying signs of slowing down as global investors engage in profit-taking. Lingering concerns over higher-for-longer interest rates, coupled with cautious statements from Fed members last week, contribute to the subdued gains. Rising US Treasury yields further dampen the potential for equity market upswings.

Nasdaq is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the index might experience technical correction since the RSI stays above the midline.

Widerstandsniveau: 18150,00, 19255,00

Unterstützungsniveau: 17280,00, 16670,00

The New Zealand Dollar’s bullish momentum has paused, with the currency experiencing a weakening at the week’s outset. Market participants are recalibrating their positions in anticipation of the Reserve Bank of New Zealand’s (RBNZ) rate decision, which is set for the upcoming Wednesday. The latest Producer Price Index (PPI) data indicates that while inflation in New Zealand continues to be persistent, the country’s economic performance shows signs of softening. This creates a complex scenario for the RBNZ, presenting a challenging decision-making environment regarding its monetary policy direction.

The NZD/USD faced strong resistance levels at near 0.6202. The MACD has declined and is approaching the zero line while the RSI gradually moves downward, suggesting the bullish momentum is vanishing.

Widerstandsniveau: 0,6205, 0,6250

Unterstützungsniveau: 0,6150, 0,6094

The Japanese Yen is presently among the weakest currencies, trading above the 150 mark against a softening U.S. dollar. This situation has ignited speculation in the market about a potential intervention by the Bank of Japan (BoJ) at such levels. Meanwhile, the Yen faces an imminent challenge with the upcoming release of Japan’s National Core Consumer Price Index (CPI) data. The BoJ will closely examine this inflation data to determine whether a shift in its monetary policy is warranted, making the reading a critical point of focus for both policymakers and market participants.

Die USD/JPY-Paarung ist über ihr absteigendes Dreiecksmuster ausgebrochen, was auf einen potenziellen Aufwärtstrend für diese Paarung hindeutet. Der RSI bewegt sich nahe der überkauften Zone, während der MACD Anzeichen einer Erholung von der Nulllinie aufweist, was auf ein neues zinsbullisches Momentum schließen lässt.

Widerstandsniveau: 151,85, 154,80

Unterstützungsniveau:149,50, 147,60

Oil prices retreat from a formidable resistance level, registering a weekly decline, as indications from US central bank policymakers suggest potential delays in interest rate cuts. Fed Governor Christopher Waller’s remarks emphasise a possible postponement by at least two more months. The tightening monetary policy outlook impacts economic growth, affecting the appeal of the black commodity. Investors keenly await China’s PMI data to gauge the effectiveness of economic recovery measures, as China plays a pivotal role as a major global oil importer.

Oil prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the commodity might extend its losses toward support level.

Widerstandsniveau: 78,65, 81,20

Unterstützungsniveau: 75,20, 71,35

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!