App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

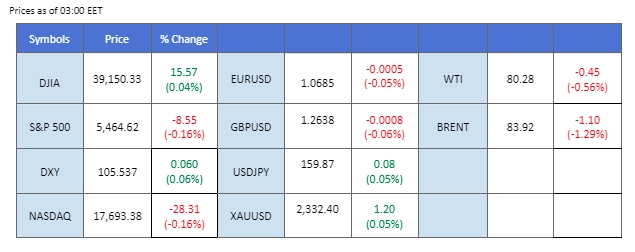

All eyes are on the Japanese Yen as it continues its downward slide against its peers, notably experiencing a 3% decline against the dollar in June. As the USD/JPY pair approaches the critical 160 mark, Japan’s top currency official has heightened concerns by stating that Japanese authorities are prepared to intervene in the currency market around the clock if necessary. Despite the strong upward momentum for the pair, traders should exercise caution due to the potential for market intervention and the upcoming release of the BoJ Core CPI reading on Tuesday.

In the U.S., the dollar traded strongly last Friday, driven by market speculation of prolonged and elevated monetary tightening by the Federal Reserve on upbeat PMI readings, which bolstered the dollar’s upward momentum. Traders are now focusing on the U.S. 5-year note auction on Wednesday and paying close attention to Friday’s PCE reading, both of which could significantly impact the dollar’s trajectory.

In the commodity market, gold prices plummeted last Friday after the U.S. PMI readings exceeded market expectations, triggering panic selling. On the other hand, oil prices were suppressed by larger-than-expected crude stockpile data released on Thursday, further weighing down the market sentiment.

Aktuelle Wetten auf eine Zinserhöhung 31. Juli Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (91,7%) VS -25 bps (8,3%)

(MT4 Systemzeit)

Quelle: MQL5

The Dollar Index rebounded as Federal Reserve officials continued to emphasize caution and the need for more data before considering interest rate cuts. This stance contrasted with other major central banks, such as the European Central Bank. Recent robust economic data has bolstered market confidence in the US outlook. The US Services Purchasing Managers Index (PMI) rose from 54.8 to 55.1, surpassing expectations of 53.4. Additionally, Existing Home Sales and the S&P Global US Manufacturing PMI exceeded forecasts, coming in at 4.11 million and 51.7, respectively, compared to expected figures of 4.08 million and 51.0.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 106.35, 107.00

Support level: 105.65, 105.15

Gold prices fell sharply following the release of better-than-expected US economic data. The improved Manufacturing and Services PMI figures boosted market confidence in the US economy, prompting a selloff in gold as the dollar strengthened. Despite recent disappointing US economic performances, last Friday’s data reversed sentiment, leading investors to shift away from safe-haven assets like gold. This week, investors will focus on the Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) Price Index, due on Friday, for further trading signals.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2365.00, 2410.00

Support level: 2315.00, 2290.00

The Pound Sterling is currently trading on a downward trajectory, primarily due to the strengthening of the U.S. dollar. The recent upbeat U.S. PMI readings have fueled the dollar’s upward momentum, with market expectations leaning towards a more hawkish approach from the Federal Reserve. Additionally, the upcoming UK general election next week has introduced a layer of political uncertainty, further casting a shadow on the Sterling’s strength.

GBP/USD is currently trading at its then resistance level, which suggests a bearish signal for the pair. The RSI is on the brink of breaking into the oversold zone, while the MACD edged lower after being rejected at the zero line, suggesting that the bearish momentum is overwhelming.

Widerstandsniveau: 1,2660, 1,2760

Support level: 1.2600, 1.2540

The EUR/USD pair has once again traded down to its crucial support level at 1.0680. Last Friday, the PMI readings from both the U.S. and the eurozone were released, impacting the euro’s strength and putting pressure on the pairing. The U.S. PMI readings exceeded market expectations, reinforcing the anticipation of a hawkish stance from the Federal Reserve. In contrast, the eurozone PMI readings fell short of expectations, raising concerns about the economic performance in the region.

The EUR/USD pair is approaching its support level, and it may perform a technical rebound from such a level. The RSI continues to flow in the lower region, while the MACD has a higher high pattern, suggesting that the bearish momentum is easing.

Resistance level: 1.0730, 1.0760

Support level: 1.0680, 1.0612

The tech-heavy Nasdaq retreated slightly as investors took profits following the Federal Reserve’s hawkish tone and the release of better-than-expected US Manufacturing and Services PMI data. This data complicated the monetary policy outlook for the Fed. With another crucial US inflation report due later this week, investors opted to sell off high-risk equities and adopt a wait-and-see approach. The market remains cautious as it anticipates further guidance on the Fed’s policy direction

Nasdaq is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 66, suggesting the index might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 20084.75, 20695.00

Support level: 19685.00, 19370.00

The Japanese Yen continues to show lackluster performance and is approaching the critical 160 mark against the dollar. The Japanese authorities have expressed concern over the weak performance of the country’s currency, stating that the government is prepared to intervene in the currency market if necessary. Yen traders should also pay attention to Tuesday’s BoJ Core CPI reading, while remaining cautious about potential BoJ intervention.

USD/JPY continues to trade with strong upward momentum, suggesting a bullish bias for the pair. The RSI is hovering in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains strong.

Resistance level: 161.20, 162.00

Support level: 158.75, 157.90

Crude oil prices retreated slightly, mainly due to the appreciation of the US dollar, which reduced the appeal of dollar-denominated oil. However, the long-term outlook for the oil market remains optimistic, with expectations that global central banks might ease monetary policy to stimulate economic growth, potentially benefiting oil demand. Uncertainty persists, as the timing of rate cuts by central banks, particularly the Federal Reserve, remains unclear. Investors should continue monitoring economic developments to gauge the future prospects for oil demand.

Oil prices are trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 47, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 82.10, 84.75

Support level: 80.05, 78.60

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!