App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

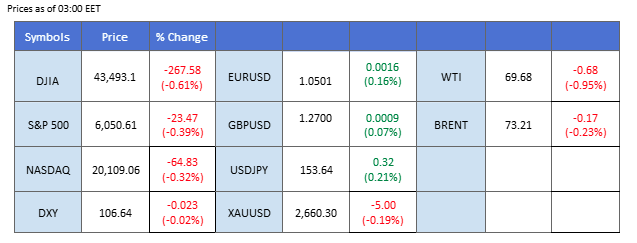

Marktübersicht

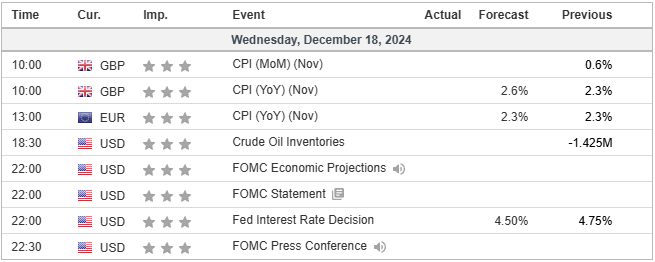

Ahead of the Fed’s interest rate decision today, the U.S. dollar maintained its recent high levels, while Wall Street faced downside risk. This market sentiment was largely driven by the U.S. retail sales data, which came in higher-than-expected and reinforced hawkish expectations for the Fed’s upcoming decision. Among the major currencies, the Pound Sterling stood out as it was buoyed by upbeat UK employment data, with the employment change reading significantly exceeding market expectations, coming in at 173k. Traders of the Pound are advised to pay close attention to tomorrow’s BoE interest rate decision, where expectations suggest the Bank of England will keep interest rates unchanged.

In the commodity market, both gold and oil faced headwinds. Gold prices were suppressed by the strengthening U.S. dollar, while the Middle East crisis seemed to be easing, reducing demand for safe-haven assets. Meanwhile, oil prices remained under pressure due to expectations of high supply and low demand in 2025, despite a surprising drawdown in U.S. crude stockpiles, as reported yesterday.

Aktuelle Wetten auf eine Zinserhöhung 18. Dezember Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (2.9%) VS -25 bps (97.1%)

(MT4 Systemzeit)

Quelle: MQL5

Marktbewegungen

DOLLAR_INDX, H4

The Dollar Index has successfully found support above its critical pivotal point near the 106.70 mark, signaling a potential trend reversal for the dollar. The greenback gained momentum following the release of upbeat U.S. Retail Sales data, which exceeded market expectations and bolstered optimism about the resilience of the U.S. economy. However, market participants remain cautious as all attention now shifts to today’s Federal Reserve monetary policy decision and the accompanying statement from Fed Chair Jerome Powell.

The Dollar Index is traded sideways, looking for higher-trade momentum. The RSI remains above the 50 level while the MACD continues to slide, suggesting that the bullish momentum is easing.

Resistance level: 106.75, 107.60

Support level: 105.70, 104.55

Gold prices remain under pressure, lacking a clear catalyst in recent sessions and trading at new near-term lows, indicating a bearish bias for the precious metal. With the Federal Reserve’s interest rate decision scheduled for today, market participants are bracing for potential hawkish signals from the central bank. A robust dollar would likely weigh on gold prices, exerting additional downside pressure as the non-yielding asset becomes less attractive in a rising rate environment.

Gold slides to a new low and is trading with a lower-high price pattern, suggesting a bearish signal for the gold. The RSI is close to the oversold zone, while the MACD has broken below the zero line, suggesting that bearish momentum is forming.

Widerstandsniveau: 2656,00, 2718,00

Support level: 2612.00, 2555.00

The GBP/USD pair edged higher in the previous session, supported by robust UK job data, but faced rejection at the critical short-term resistance level of 1.2725. The Pound Sterling gained momentum as employment change figures came in significantly stronger than market expectations, underscoring resilience in the UK labour market. However, the pair’s upward trajectory remains uncertain as traders focus on today’s Fed’s interest rate decision, accompanied by Jerome Powell’s statement; while the UK CPI reading is expected to provide fresh insights into inflation trends and the Bank of England’s future policy stance.

GBP/USD rebounded strongly from its recent low level but faced strong selling pressure when approaching the 1.2725 mark; a break above such a level shall be seen as a bullish signal for the pair. The RSI continues to climb while the MACD attempts to break above the zero line, suggesting that a bullish momentum is forming.

Widerstandsniveau: 1,2790, 1,2850

Support level:1.2620, 1.2505

The EUR/USD pair has remained largely sideways as the market closely monitors the ongoing political crisis in Germany and its potential impact on the euro. Political uncertainty in Europe’s largest economy has added to the pressure on the euro, making it susceptible to fluctuations. Additionally, today’s eurozone CPI reading is expected to show an uptick in inflation, which could provide some support for the euro. A higher-than-expected inflation print may reinforce expectations of tighter monetary policy from the European Central Bank, potentially giving the euro a boost against the U.S. dollar.

Die EUR/USD-Paarung scheint bei der Marke von 1,0520 einem starken Verkaufsdruck ausgesetzt zu sein, was auf eine rückläufige Tendenz für diese Paarung hindeutet. Der RSI bewegt sich nahe der 50er-Marke, während der MACD nahe der Nulllinie verharrt, was auf ein neutrales Signal für diese Paarung hindeutet.

Resistance level: 1.0606, 1.0702

Support level: 1.0440, 1.0324

The NZD/USD pair has fallen to its lowest level since November 2022, recording a decline of more than 2.5% in December so far, signaling a bearish outlook for the pair. The New Zealand dollar has been weighed down by the Reserve Bank of New Zealand’s dovish stance, with a 50 basis point rate cut in November. This, coupled with a weak economic performance in China—the country’s largest trading partner—has further dampened the Kiwi’s strength. Additionally, the pair may face further downside pressure if the Federal Reserve adopts a more hawkish stance in today’s monetary policy decision announcement.

The NZD/USD pair is trading in a lower-high price pattern, suggesting a bearish signal for the pair. The RSI remains in the lower region while the MACD flows flat below the zero line, suggesting the pair is trading with bearish momentum.

Resistance level: 0.5800, 0.5860

Support level: 0.5730, 0.5665

Despite a slight correction at its recent peak, the USD/JPY continues to trade within its uptrend trajectory. A breakout above the recent high of 154.20 could signal further bullish momentum for the pair. The Japanese Yen remains lacklustre, with market expectations of a dovish Bank of Japan (BoJ) stance weighing on its performance. Meanwhile, a potential strengthening of the U.S. dollar following today’s Fed interest rate decision could fuel further upward momentum for the USD/JPY pair, reinforcing the bullish outlook in the short term.

The pair is hovering flat at its recent high level; a break above its recent peak at the 154.15 mark shall be seen as a bullish signal for the pair. The RSI remain close to the overbought zone while the MACD has crossed on the above, suggesting the bullish momentum may be easing.

Resistance level: 157.15, 160.05

Support level: 151.55, 149.00

Oil prices continued to decline, reaching new recent lows before staging a partial recovery following a surprising drawdown in U.S. crude stockpiles. The inventory data released yesterday provided temporary relief, erasing some of oil’s earlier losses. However, the broader market sentiment remains weighed down by excessive downside pressure, driven by concerns over future supply and demand dynamics.

Oil prices traded to a new low after facing rejection from its short-term resistance level near the 71.30 mark, suggesting a bearish bias for the oil. The RSI is heading toward the oversold zone while the MACD continues to slide, suggesting that the bullish momentum is vanishing.

Resistance level: 72.30, 74.65

Unterstützungsniveau: 68,25, 67,00

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!