App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

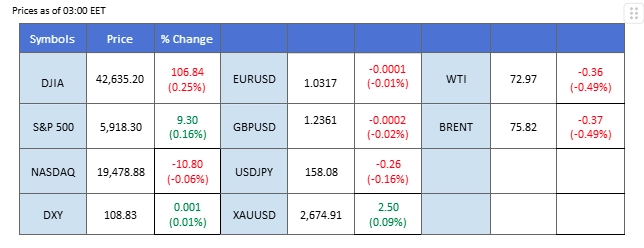

Marktübersicht

The dollar index remains elevated in recent highs as markets await the highly anticipated U.S. Nonfarm Payrolls (NFP) data today. This key job report will provide insight into the Fed’s hawkish stance and its impact on dollar strength. With the NFP expected at 164k, a higher-than-anticipated reading could drive the dollar higher. Meanwhile, traders are also focusing on the Japanese yen, wary of potential market intervention by Japanese authorities, which could strengthen the currency. The Bank of Japan’s acknowledgment of satisfying wage growth has also increased speculation of a January rate hike.

In commodities, oil prices have recovered losses from the previous session, supported by a sharp decline in U.S. Cushing crude inventories, the largest since October. Conversely, gold prices remain steady but show signs of weakening bullish momentum. A stronger-than-expected NFP reading could weigh heavily on gold, reversing its recent gains as the dollar strengthens.

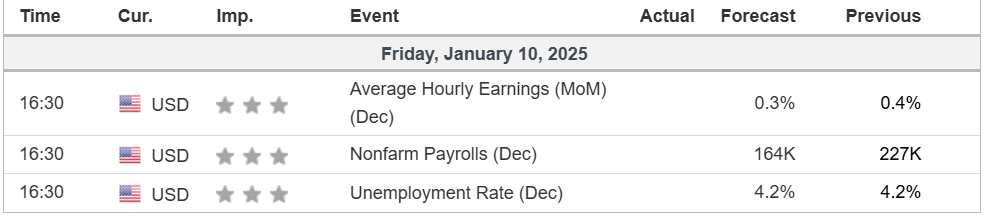

Aktuelle Wetten auf eine Zinserhöhung 29. Januar Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (93.1%) VS -25 bps (6.9%)

(MT4 Systemzeit)

Quelle: MQL5

Marktbewegungen

DOLLAR_INDX, H4

The Dollar Index continued its rally, supported by robust US economic performance and hawkish Fed expectations. Economists forecast Nonfarm Payrolls to decline to 227K while unemployment remains at 4.2%. Meanwhile, the Federal Reserve’s FOMC meeting minutes revealed concerns about inflation, with officials citing potential risks stemming from Trump’s policy proposals, including deregulation and tax cuts. These inflationary concerns could prompt the Fed to maintain a higher interest rate environment, further supporting the dollar’s rally.

The Dollar Index is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 62, suggesting the index might experience technical correction since the RSI retreated sharply from overbought territory.

Widerstandsniveau: 109,50, 110,60

Support level: 107.65, 105.75

Gold prices surged, breaking through a key resistance level, as investors flocked to safe-haven assets amid heightened market uncertainties. Concerns over trade policies, combined with potential volatility from upcoming Nonfarm Payrolls and unemployment rate data, have bolstered demand for gold. Although a hawkish Fed tone and strong US economic data typically weigh on gold prices, persistent uncertainties surrounding Trump’s policies have kept global investors in a risk-off mode

Gold prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 2685.00, 2720.00

Support level: 2665.00, 2635.00

The GBP/USD pair traded quietly in the last session, hovering near recent lows as the strengthened U.S. dollar continued to exert pressure. Traders are closely monitoring today’s U.S. Nonfarm Payrolls (NFP) data, which is expected to significantly influence the dollar’s strength and the pair’s movement. A stronger-than-expected NFP reading could reinforce the Fed’s hawkish stance, potentially driving the pair to fresh lows.

The pair consolidated in the last session at its recent low level, giving a neutral signal. The RSI is flowing flat near the oversold zone while the MACD continues to edge lower, suggesting that the pair is trading with strong bearish momentum.

Resistance level: 1.2410, 1.2505

Support level: 1.2220, 1.2140

The EUR/USD pair has been trading flat in recent sessions, awaiting a catalyst to determine its direction. The euro faced additional downside pressure as Eurozone Retail Sales fell to 1.2%, below the previous reading. The pair’s movement remains heavily influenced by the U.S. dollar, making today’s Nonfarm Payrolls (NFP) report a critical event for traders to gauge the pair’s future direction.

The pair is currently testing its uptrend support level at near 1.0300, which is also its psychological support level; a break below such a level would be a bearish signal for the pair. The RSI has been sliding, while the MACD continues to edge lower after breaking below the zero line, suggesting that the pair is trading with bearish momentum.

Widerstandsniveau: 1,0330, 1,0458

Unterstützungsniveau: 1,0230, 1,0112

The USD/JPY pair is approaching a critical level near the 160.00 mark, a threshold the Japanese authorities are keen to avoid, raising the possibility of market intervention to support the Yen. With the U.S. Nonfarm Payrolls (NFP) report due today, concerns from Japan have intensified, as a strong dollar could push the pair to this level. However, expectations of a hawkish Bank of Japan (BoJ) interest rate decision in the near term have provided some support for the Yen, potentially limiting the pair’s upside.

The USD/JPY has been trading flat for the past three weeks but has been gradually edging higher, suggesting a bullish bias for the pair. The RSI has been supported at above the 50 level, while the MACD has been hovering above the zero line, suggesting that the pair remains trading with bullish momentum.

Resistance level: 159.15, 160.50

Support level: 157.15, 156.00

The continuous rise in UK long-term bond yields has bolstered the Pound Sterling, creating downward pressure on the GBP/AUD pair. This has resulted in a lower-high price pattern, signaling a bearish bias for the pair. On the other hand, the Australian dollar has faced headwinds from recent lackluster Chinese economic indicators, further dampening its strength. Additionally, speculation surrounding a potential February rate cut by the Reserve Bank of Australia (RBA) has weighed on the Aussie dollar, contributing to the pair’s bearish outlook.

The GBPAUD pair is trading bearishly as a lower-high price pattern is formed. The RSI is hovering close to the oversold zone, while the MACD is edging lower at below the zero line, suggesting that the pair is trading with bearish momentum.

Resistance level: 1.9930, 2.0060

Support level: 1.9790, 1.9690

Oil prices rebounded more than 1%, supported by surging winter fuel demand as cold weather gripped parts of the US and Europe. The Energy Information Administration (EIA) reported that US Gulf Coast refiners raised crude oil net inputs to their highest levels since December 2018. JPMorgan analysts project that January oil demand will expand by 1.4 million barrels per day (bpd) year-on-year, reaching 101.4 million bpd, largely due to increased use of heating fuels in the Northern Hemisphere.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 62, suggesting the commodity might experience technical correction since the RSI retreated from overbought territory.

Resistance level: 74.85, 75.95

Support level: 73.60, 72.75

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!