App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

Marktübersicht

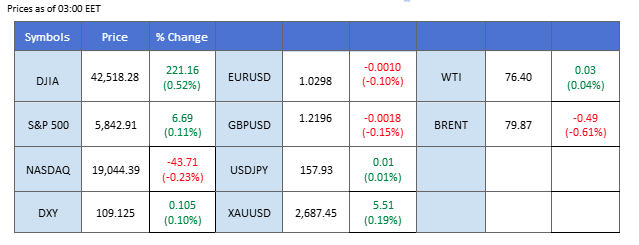

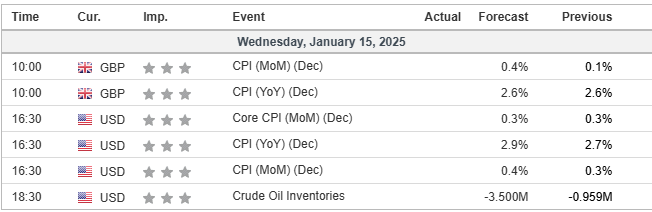

The market remains steady as traders await the release of the highly anticipated U.S. CPI data today, a crucial gauge for inflation trends and potential monetary policy moves. Recent U.S. economic indicators suggest that the Federal Reserve may keep interest rates unchanged through the first quarter of 2025, making today’s CPI reading pivotal for confirming these expectations. Simultaneously, attention is also on the UK CPI data, where a higher-than-expected reading could provide a boost to the Pound Sterling.

In the commodities market, gold has found support above the $2,670 mark following a sharp decline in previous sessions. However, progress in the ceasefire negotiations between Israel and Gaza could cap further gains, as reduced geopolitical risks often dampen demand for safe-haven assets. Meanwhile, oil prices remain in a bullish trend despite a recent technical pullback, supported by U.S. EIA forecasts of continued crude stockpile drawdowns and the impact of U.S. sanctions on Russian oil exports.

In the cryptocurrency market, sentiment is recovering, with major tokens regaining much of their recent losses. Enthusiasm is building ahead of President-elect Donald Trump’s inauguration on January 20th, with speculations that his administration’s potential crypto-friendly policies could spark a rally in cryptocurrency prices.

Aktuelle Wetten auf eine Zinserhöhung 29. Januar Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (97,9%) VS -25 bps (2,1%)

(MT4 Systemzeit)

Quelle: MQL5

Marktbewegungen

DOLLAR_INDX, H4

The dollar eased slightly following disappointing U.S. PPI data, which dropped from 0.40% to 0.20%, missing market expectations. The downbeat data added modest pressure on the dollar as markets now turn their focus to the U.S. CPI report due later today, which could provide clearer signals on inflation and Federal Reserve policy.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 64, suggesting the index might experience technical correction since the RSI retreated from overbought territory.

Widerstandsniveau: 110,00, 111,75

Support level: 106.30, 103.70

Gold continued to gain traction, supported by its safe-haven appeal amidst rising trade tensions. Bloomberg reported that the Trump administration is considering phased tariff hikes, potentially ranging from 10% to 60% on imports, including goods from China. If implemented, these tariffs could escalate trade uncertainties, further underpinning gold prices as a geopolitical hedge.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 52, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2690.00, 2720.00

Support level: 2660.00, 2635.00

The GBP/USD pair gained support from a softened U.S. dollar in the recent session, as market sentiment shifted amid diminishing concerns over Trump’s tariff policies. Traders are now focused on the upcoming UK CPI data, which is expected to show a higher reading compared to the previous release. If the data aligns with market expectations, it could provide a catalyst for the Pound Sterling to strengthen further, potentially driving the pair higher in the near term.

The pair has formed a higher-low price pattern after a drastic plunge previously, suggesting a potential trend reversal. The RSI has gotten out from the oversold zone, while the MACD has a golden cross at the bottom, suggesting that the bearish momentum is easing.

Resistance level: 1.2310, 1.2410

Support level: 1.2140, 1.2060

The EUR/USD pair extended its gains in yesterday’s session, approaching its previous sideways range. A decisive break above the current level would signal a potential bullish trend for the pair. The upward momentum has been supported by a softening U.S. dollar, as market sentiment shifts toward expectations of more trade-friendly policies under Trump’s administration, dampening the dollar’s recent strength.

The pair continues its rally, rebounding from its previous downtrend, suggesting a trend reversal. The RSI has rebounded sharply to near the overbought zone, while the MACD is heading to the zero line from below, suggesting that the bearish momentum is vanishing.

Resistance level: 1.0458, 1.0606

Unterstützungsniveau: 1,0230, 1,0112

The EUR/GBP pair has rallied to its highest level since last November, with a breakout above this level likely to signal a bullish continuation. Despite the euro’s recent lackluster performance against the Pound Sterling, traders are closely monitoring CPI readings from key eurozone member states, including Spain and France, scheduled for release today. These inflation figures are expected to provide insights into the euro’s potential strength and influence the pair’s next directional move.

The EUR/GBP has surged by more than 1.6% after the pair broke above its resistance level at 0.8300 last week. The RSI remains in the overbought zone, while the MACD remains elevated, suggesting that the bullish momentum remains strong.

Resistance level: 0.8490, 0.8560

Support level: 0.8415, 0.8360

The Dow Jones rebounded slightly, buoyed by dropping yields. U.S. Treasury yields declined, with the 10-year yield down 2 basis points after the weaker PPI data. The dip offered limited relief to equities, as investors maintained a cautious stance ahead of the CPI report. Equity markets saw only marginal recovery as traders awaited inflation data to assess the broader economic outlook.

Dow Jones is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 43, suggesting the index might extend its gains since the RSI rebounded from oversold territory.

Resistance level: 42900.00, 43920.00

Support level: 41875.00, 40610.00

Oil prices hovered near a four-month high in Asian trading, with Brent crude supported by new U.S. sanctions targeting Russia’s oil and gas revenues. The sanctions raised concerns about supply constraints, with analysts forecasting Brent could push toward $90 per barrel as buyers seek alternative sources. Market participants remain watchful for the U.S. inflation report, which could impact broader demand trends.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 68, suggesting the commodity might enter overbought territory.

Resistance level: 78.75, 83.75

Support level: 72.95, 66.85

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!