App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

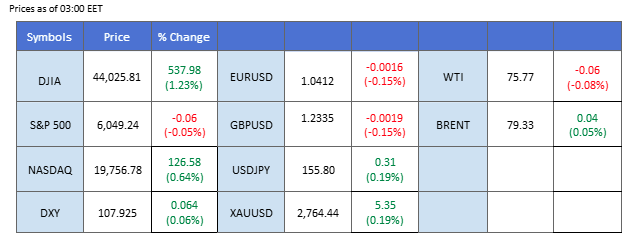

Marktübersicht

Wall Street surged after reopening from Monday’s public holiday, fueled by optimism surrounding Trump’s administration, which is anticipated to support equities as in his previous term. The Dow Jones led the rally, gaining over 500 points and marking a 5% recovery from its three-month lows, signaling a potential bullish trend reversal.

Meanwhile, the dollar faced significant volatility, with the dollar index fluctuating by around 100 pips as markets remained cautious over Trump’s trade policies. This uncertainty increased demand for safe-haven gold, driving it to its highest level since last November.

In the forex market, the Canadian dollar strengthened briefly following a higher-than-expected CPI reading but remained under pressure, especially against the U.S. dollar, as Trump targeted Canada with potential tariffs. Similarly, the New Zealand dollar rose after upbeat CPI data but faces potential headwinds from a possible U.S.-China trade war under Trump’s leadership.

The cryptocurrency market saw renewed enthusiasm after the SEC’s new leadership announced plans for a crypto-focused task force aimed at refining the U.S. legal framework, which is expected to enhance the crypto trading environment.

Aktuelle Wetten auf eine Zinserhöhung 29. Januar Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (97,9%) VS -25 bps (2,1%)

Marktübersicht

Wirtschaftskalender

(MT4 Systemzeit)

K.A.

Quelle: MQL5

Marktbewegungen

DOLLAR_INDX, H4

The U.S. dollar dipped as investors remained in a wait-and-see mode due to the absence of crucial economic data releases. Market movements were primarily driven by the digestion of Trump’s inauguration, with uncertainties surrounding potential trade tariffs weighing on sentiment. Traders remain cautious as they assess how Trump’s future policies might impact U.S. inflation and Federal Reserve decisions. As a result, the dollar continued to consolidate within a defined range, finding support and resistance as investors await further policy clarity.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 33, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 109.00, 110.00

Support level: 107.95, 106.80

Gold prices broke out of their sideways trading range, reaching new highs in recent sessions and signaling a bullish outlook for the precious metal. The rally is driven by increased demand for gold as a safe-haven asset amid heightened uncertainty surrounding Trump’s administration. Market sentiment remains cautious, with the dollar index’s recent erratic movements reflecting uncertainty about the nature of Trump’s upcoming executive actions, further boosting gold’s appeal.

Gold prices gained more than 1% in the last session and broke above their sideways range, suggesting a bullish bias for gold. The RSI has gotten into the overbought zone while the MACD continues to surge, suggesting that the gold remains trading with bullish momentum.

Resistance level: 2789.00, 2830.00

Support level: 2718.35, 2665.00

The British pound strengthened against the U.S. dollar after reports indicated that Trump’s initial executive orders did not include new tariffs on the UK. The market had initially anticipated a more aggressive protectionist stance, leading to sharp dollar weakness as traders recalibrated their expectations. With uncertainty still lingering, investors remain attentive to any policy shifts that could influence the broader forex landscape.

GBP/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the pair might extend its gains since the RSI stays above the midline.

Widerstandsniveau: 1,2485, 1,2610

Support level: 1.2305, 1.2150

Uncertainty over U.S. trade policy intensified after President Trump suggested imposing a 25% tariff on imports from Canada and Mexico, set to take effect on February 1st. While details remain unclear, the mere possibility of such tariffs sent the Canadian dollar tumbling. Investors are closely monitoring upcoming White House statements for confirmation or further developments that could impact trade relations and currency markets.

USD/CAD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 43, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Widerstandsniveau: 1,4450, 1,4525

Unterstützungsniveau: 1,4305, 1,4190

The Japanese yen continued its upward momentum, supported by growing speculation that the Bank of Japan (BoJ) will raise interest rates in its upcoming policy meeting on Friday. Japan’s top currency diplomat, Atsushi Mimura, emphasized concerns about yen weakness driving up import costs and contributing to inflation. His remarks reinforced expectations that the government and central bank are closely monitoring currency fluctuations. Currently, market participants are pricing in an 86.2% probability of a 25-basis-point BoJ rate hike, further fueling yen appreciation.

USD/JPY is trading lower following the prior breakout below the previous support level. However, MACD has illustrated increasing bullish momentum, while RSI is at 46, suggesting the pair might experience technical correction since the RSI rebounded from oversold territory.

Resistance level: 156.00, 157.30

Support level: 154.25, 152.50

The Dow Jones extended its rally after the financial market reopened following Monday’s public holiday, supported by heightened risk-on sentiment fueled by Donald Trump’s return to office. The president-elect’s initial protectionist executive actions on trade policy have further bolstered investor confidence, creating an encouraging backdrop for the U.S. equity market to sustain its upward momentum.

Dow Jones has gained more than 5% since last week from its 3-month low, suggesting a bullish bias for the Dow. The RSI has reached the overbought zone, while the MACD has broken above the zero line, suggesting bullish momentum is forming.

Resistance level: 45380.00, 47250.00

Support level: 42950.00, 41880.00

The NZD/USD pair has developed an inverted head-and-shoulders pattern, signaling a potential bullish outlook. While the pair fluctuated in the last session, driven largely by the U.S. dollar’s strength from the “Trump-trade” effect, the Kiwi found support from stronger-than-expected New Zealand CPI data released during the Sydney session, which exceeded market expectations and bolstered the currency.

The NZD/USD pair has reached its two-week high after forming the inverted head-and-shoulders price pattern, suggesting a bullish bias for the pair. The RSI continues to climb while the MACD continues to surge after breaking above the zero line, suggesting that the pair remains trading with bullish momentum.

Resistance level: 0.5735, 0.5780

Support level: 0.5615, 0.5545

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!