App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

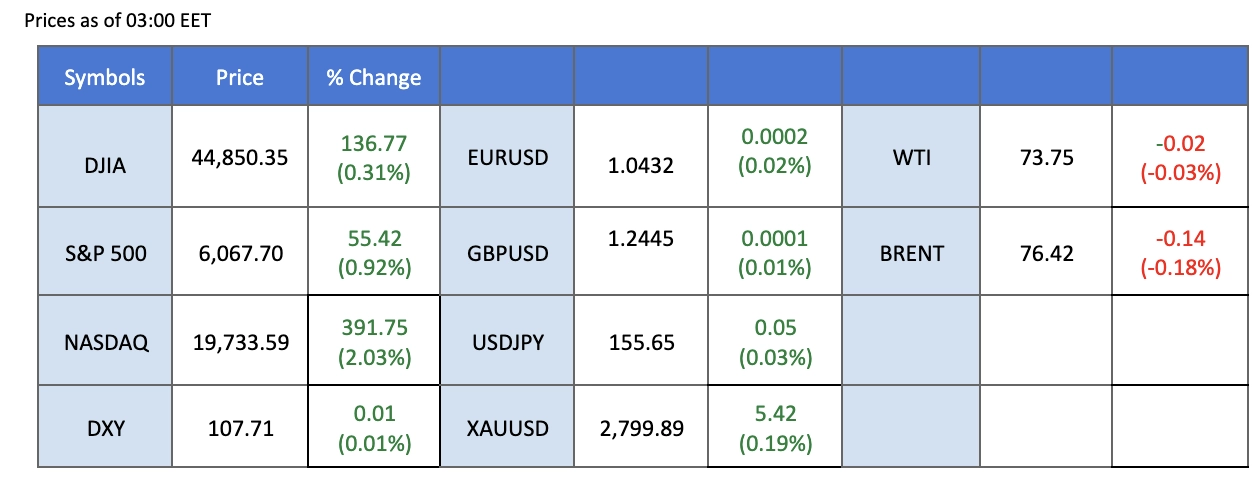

Marktübersicht

Der US-Dollar blieb im Vorfeld wichtiger Zentralbankentscheidungen fest, wobei USD/CAD leicht anstieg, da Händler eine Zinssenkung der Bank of Canada erwarteten. Derweil blieb die Marktstimmung im Vorfeld der Sitzung der Federal Reserve vorsichtig, da die Anleger genau auf Signale für künftige Zinsänderungen achten. Der Goldpreis erholte sich nach den jüngsten Verkäufen, wobei seine Entwicklung von den Aussichten der Fed und der Nachfrage nach sicheren Häfen abhing.

Die Ölpreise blieben im asiatischen Handel stabil, nachdem die US-Rohölbestandsdaten einen geringer als erwartet ausgefallenen Aufbau zeigten, doch hielten die Bedenken über schwache chinesische Wirtschaftsdaten und anhaltende Handelsrisiken die Preise unter Druck. Unterdessen weitete der australische Dollar seine Verluste den dritten Tag in Folge aus, da schwache Inflationsdaten die Erwartungen einer Zinssenkung durch die RBA im Februar verstärkten, was Abwärtsrisiken für AUD/USD mit sich brachte.

Bitcoin hielt sich über der Marke von $100K, unterstützt durch Dip-Käufe und Optimismus über mögliche kryptofreundliche Regulierungen. Am Aktienmarkt erholten sich die US-Aktien, angeführt von der Erholung von Nvidia nach einem historischen Ausverkauf. Trotz der Erholung bleibt die Volatilität hoch, da die Anleger die Auswirkungen von DeepSeek AI auf die Tech-Giganten und die allgemeinen Marktbedingungen bewerten.

Aktuelle Wetten auf eine Zinserhöhung 29. Januar Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (97,3%) VS -25 bps (2,7%)

Marktübersicht

Wirtschaftskalender

(MT4 Systemzeit)

Quelle: MQL5

Marktbewegungen

DOLLAR_INDX, H4

Vor der zweitägigen Sitzung der US-Notenbank, die am Mittwoch zu Ende geht, blieben die wichtigsten Märkte zurückhaltend. Es wird zwar allgemein erwartet, dass die Fed ihren derzeitigen Kurs beibehält, aber die Anleger beobachten ihre Erklärung genau, um Erkenntnisse über die künftige politische Richtung zu gewinnen. Die wiederholten Forderungen des ehemaligen US-Präsidenten Trump nach Zinssenkungen haben den Ausblick noch unsicherer gemacht und halten die Händler in Atem. Der Dollar-Index blieb unverändert, da die Anleger eine abwartende Haltung einnahmen.

Der Dollar-Index handelt flach und testet derzeit die Widerstandsmarke. Der MACD zeigt jedoch ein nachlassendes zinsbullisches Momentum, während der RSI bei 52 liegt, was darauf hindeutet, dass sich der Index in einer Zone konsolidieren könnte, da der RSI nahe der Mittellinie liegt.

Widerstandsniveau: 107,95, 109,00

Unterstützungsniveau: 106,80, 105,75

Die Goldpreise erholten sich, als sich die Marktstimmung stabilisierte und die Anleger dazu veranlasste, ihre Positionen nach dem jüngsten Ausverkauf wieder aufzustocken. Der Rückgang war durch institutionelle Liquidationen zur Deckung von Nachschussforderungen nach den Auswirkungen von DeepSeek AI auf die Wall Street bedingt, die einen starken Ausverkauf des Nasdaq auslösten. Die weitere Entwicklung des Goldpreises hängt weiterhin von den politischen Aussichten der Fed ab, wobei die geldpolitischen Erwartungen eine wichtige Rolle bei der Gestaltung der Nachfrage nach sicheren Häfen spielen.

Der Goldpreis wird höher gehandelt und testet derzeit die Widerstandsmarke. Der MACD zeigt jedoch ein nachlassendes zinsbullisches Momentum, während der RSI bei 69 liegt, was darauf hindeutet, dass der Rohstoff in den überkauften Bereich eintreten könnte.

Widerstandsniveau: 2765,00, 2785,00

Unterstützungsniveau: 2740,00, 2720,00

USD/CAD legte leicht zu, da die Nachfrage nach dem US-Dollar im Vorfeld wichtiger Zentralbankentscheidungen fest blieb. Es wird erwartet, dass die Fed die Zinssätze konstant hält, aber die Händler achten auf Signale für zukünftige Änderungen der Politik, insbesondere da Trump weiterhin auf sofortige Zinssenkungen drängt. Unterdessen wird erwartet, dass die Bank of Canada die Zinsen um 25 Basispunkte auf 3,0% senken wird, was den kanadischen Dollar belasten könnte.

USD/CAD handelt nach der vorherigen Erholung von der Unterstützungsmarke höher. Der MACD zeigt jedoch ein nachlassendes zinsbullisches Momentum, während der RSI bei 54 liegt, was darauf hindeutet, dass sich das Paar konsolidieren könnte, da der RSI nahe der Mittellinie liegt.

Widerstandsniveau: 1,4450, 1,4525

Unterstützungsniveau: 1,4305, 1,4190

Der australische Dollar baute seine Pechsträhne den dritten Tag in Folge aus und erreichte ein Wochentief, nachdem schwächer als erwartet ausgefallene Inflationsdaten die Erwartungen einer Zinssenkung durch die Reserve Bank of Australia (RBA) im Februar verstärkt hatten. Der Verbraucherpreisindex (CPI) stieg nur um 0,20% und verfehlte damit die Prognose von 0,30%. Darüber hinaus trübten erneute Bedenken hinsichtlich der Wirtschaftsaussichten Chinas und der Handelsspannungen mit den USA die Stimmung weiter ein und erhöhten die Abwärtsrisiken für AUD/USD im Vorfeld der FOMC-Entscheidung.

AUD/USD handelt nach dem vorherigen Ausbruch unter die vorherige Unterstützungsmarke schwächer. Der MACD zeigt ein abnehmendes zinsbullisches Momentum, während der RSI bei 37 liegt, was darauf hindeutet, dass das Paar seine Verluste ausweiten könnte, da der RSI unterhalb der Mittellinie bleibt.

Widerstandsniveau: 0,6525, 0,6290

Unterstützungsniveau: 0,6200, 0,6145

Die US-Aktien schlossen am Dienstag höher, angeführt von einer Erholung bei Nvidia und anderen KI-verbundenen Tech-Aktien. Der Nasdaq übertraf die Erwartungen, da Nvidia nach einem Rekordverlust von $593 Mrd. an einem einzigen Tag am Montag - dem größten Verlust in der Geschichte - wieder anstieg. Trotz der Erholung bleibt die Marktvolatilität erhöht, da die Anleger die Wettbewerbsbedrohung durch DeepSeek AI für die US-Tech-Giganten verarbeiten.

Der Nasdaq wird nach dem vorherigen Ausbruch über den vorherigen Widerstand höher gehandelt. Der MACD zeigt ein zunehmendes zinsbullisches Momentum, während der RSI bei 51 liegt, was darauf hindeutet, dass der Index seine Gewinne weiter ausbauen könnte, da der RSI aus dem überverkauften Bereich stark zurückgekommen ist.

Widerstandsniveau: 21820,00, 22140,00

Unterstützungsniveau: 21255,00, 20765,00

Die Ölpreise stabilisierten sich am Mittwoch im asiatischen Handel, nachdem Branchendaten einen geringer als erwarteten Anstieg der US-Rohöllagerbestände zeigten. Das American Petroleum Institute meldete für die vergangene Woche einen Anstieg um 2,86 Millionen Barrel, was unter den Markterwartungen von 3,7 Millionen Barrel lag. Sorgen über schwache chinesische Wirtschaftsdaten und die Handelszollpläne von Präsident Trump belasten jedoch weiterhin die Stimmung und halten die Rohölpreise unter Druck.

Rohöl wird nach der vorangegangenen Erholung von der Unterstützungsmarke höher gehandelt. Der MACD zeigt ein zunehmendes zinsbullisches Momentum, während der RSI bei 45 liegt, was darauf hindeutet, dass der Rohstoff seine Gewinne weiter ausbauen könnte, da der RSI aus dem überverkauften Bereich stark zurückgekommen ist.

Widerstandsniveau: 74,65, 76,85

Unterstützungsniveau: 72,50, 69,85

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!