App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

App herunterladen

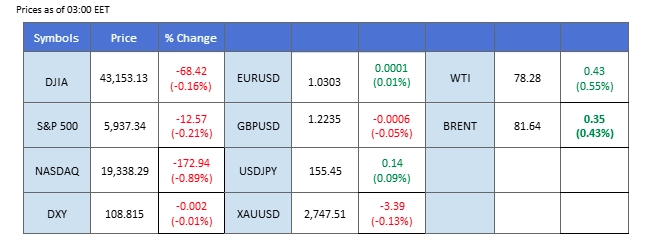

Market Summary

Wall Street’s rally paused after gaining momentum from Wednesday’s softer U.S. CPI data, as investors brace for increased volatility heading into the Q1 earnings season next week. In the forex market, dovish remarks from Fed Governor Christopher Waller, suggesting support for continued rate cuts, dampened the dollar’s strength. This sentiment was compounded by a retreat in U.S. long-term Treasury yields, further weighing on the greenback.

Traders today are focused on the UK’s retail sales and the eurozone’s CPI data, which could significantly impact the Pound Sterling and euro, respectively. Meanwhile, gold prices continued their upward trajectory, supported by the weaker dollar, but faced resistance near the $2,720 level. A decisive break above this point could confirm a bullish outlook for the precious metal.

Oil prices, on the other hand, declined as risks of supply disruptions eased following the conclusion of a ceasefire deal in the Middle East. In the cryptocurrency market, while Bitcoin remains bullish, attention has shifted to XRP, which has reached new highs and recently became the third-largest cryptocurrency by market capitalization. XRP’s rally is fueled by optimism over the potential launch of its ETF, following the success of Bitcoin and Ethereum ETFs.

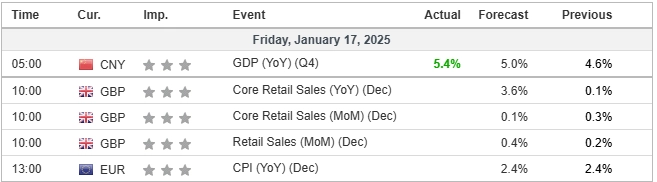

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97.9%) VS -25 bps (2.1%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

US economic reports continue to underperform expectations. Core Retail Sales grew by just 0.40%, below the anticipated 0.50%, while overall Retail Sales fell from 0.80% to 0.40%, missing the 0.60% forecast. Additionally, Initial Jobless Claims rose to 217K, higher than the expected 210K. These disappointing figures are increasing expectations that the Federal Reserve might maintain a more dovish stance on monetary policy, causing the Dollar Index to dip further.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 110.00, 111.75

Support level: 108.20, 106.80

Gold prices surged to a one-month high, driven by a drop in the dollar and Treasury yields, after softer inflation data fueled expectations of rate cuts. However, the rally was limited by easing Middle East tensions, with the Gaza ceasefire set to begin on Sunday. Despite some final negotiations, the ceasefire is seen as a positive development that has restrained further gold price gains.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 69, suggesting the commodity might experience technical correction since the RSI entered overbought territory.

Resistance level: 2720.00, 2755.00

Support level: 2690.00, 2660.00

Sterling struggled as UK GDP growth slowed to just 0.1%, missing the forecast of 0.2%. This slower growth has intensified expectations that the Bank of England may need to cut rates multiple times in 2025. Investors are waiting for further UK economic data to determine the BoE’s policy outlook.

GBP/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 49, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.2305, 1.2480

Support level: 1.2150, 1.2015

The EUR/USD pair has been trading within a narrow range recently, as both the dollar and the euro lacked significant catalysts. The U.S. dollar remained subdued following dovish remarks from a Fed governor, signaling a continued inclination toward rate cuts. This has weighed on the greenback’s momentum. Conversely, the euro could see heightened volatility, with today’s release of the eurozone CPI data expected to have a direct impact on its strength. Should the CPI reading exceed market expectations, it may provide a bullish boost to the euro and push the pair higher, while a softer reading could pressure the euro and support the dollar.

The pair edged slightly higher yesterday but will face a challenge when it approaches the 1.0340 mark. A break above such a level will be seen as a bullish signal for the pair. The RSI remains at the above 50 level, while the MACD is hovering close to the zero line, which suggests that the bullish momentum is minimal with the pair.

Resistance level: 1.0330, 1.0458

Support level: 1.0230, 1.0112

The AUD/USD pair continues to trade on elevated levels, maintaining its bullish momentum after rebounding from a recent low. The pair’s strength has been fueled by a combination of factors, including the recent robust Australian employment data and a softer U.S. dollar, which have provided a strong foundation for the uptrend. Additionally, better-than-expected Chinese economic indicators, such as GDP growth and Industrial Production, have further supported the Australian dollar, given Australia’s close trade ties with China.

The AUD/USD found support at its immediate support level at 0.6205, suggesting that the pair remains trading in a bullish trajectory. The RSI remains above the 50 level, while the MACD has broken above the zero line, suggesting that the bullish momentum is sustaining the upward movement for the pair.

Resistance level: 0.6275, 0.6345

Support level: 0.6205, 0.6130

The U.S. equity market stalled after its recent rally spurred by last Wednesday’s softer-than-expected U.S. CPI reading. The Dow Jones Industrial Average appears to lack bullish momentum, suggesting the potential for a pullback to fill the gap created during the post-CPI surge. As Wall Street transitions into the first quarter earnings report season, market volatility is expected to intensify. Investors will closely analyze corporate earnings and forward guidance to gauge the broader economic outlook, adding uncertainty to the Dow’s near-term trajectory.

The Dow traded flat after the index jumped by more than 1% on Wednesday, suggesting a potential retracement. The RSI is moving upward while the MACD is approaching the zero line from below, suggesting that the index remains trading with bullish momentum.

Resistance level: 43950.00, 45360.00

Support level: 42850.00, 41890.00

As risk appetite in the crypto market improves ahead of Donald Trump’s inauguration as the next U.S. president, XRP has surged approximately 40% this week, solidifying its position as the 3rd largest cryptocurrency by market capitalization. The rally is driven by optimism surrounding the potential launch of an XRP ETF, following the footsteps of BTC and ETH ETFs. Such a development is expected to enhance institutional interest and accessibility, which could significantly stoke demand for XRP. This increasing enthusiasm may further bolster XRP prices, with investors closely monitoring regulatory developments and market sentiment for further cues.

XRP has rallied by about 40% this week, suggesting a bullish bias. However, traders should be cautious for a technical retracement ahead. The RSI remains in the overbought zone, while the MACD continues to edge higher, suggesting that the bullish momentum remains strong.

Resistance level: 3.5560, 4.0470

Support level: 3.0160, 2.6780

Oil prices pulled back slightly after reaching a four-month high, as investors booked profits. The ceasefire deal between Israel and Hamas also contributed to downward pressure on oil prices. However, the overall outlook remains positive, as demand expectations continue to be supported by stronger-than-expected Chinese economic growth in the fourth quarter of 2024.

Oil prices are trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the commodity might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 83.75, 87.45

Support level: 77.85, 72.95

Traden Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Tradingbedingungen

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!