App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

App herunterladen

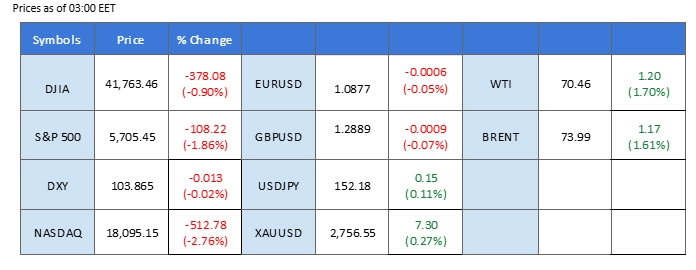

Market Summary

Despite strong U.S. economic data, the U.S. dollar saw a slight retreat as investors await the upcoming U.S. election and Nonfarm Payrolls report. Resilient figures, including a stable Core PCE Price Index at 2.70% and reduced Initial Jobless Claims (216K), highlight steady U.S. economic strength, which may influence future dollar trends.

The Euro strengthened on favorable Eurozone inflation data, with the Consumer Price Index (CPI) rising from 1.70% to 2.0%, exceeding expectations. This boost in inflation reduces the likelihood of aggressive rate cuts from the European Central Bank, bolstering demand for the Euro as investor confidence grows around potential policy adjustments.

Meanwhile, the British Pound declined following Finance Minister Rachel Reeves’ tax-focused budget, which stirred concerns over UK growth and pushed two-year gilt yields higher. Gold prices dipped amid U.S. economic stability, while oil prices edged up due to rising geopolitical tensions and speculation that OPEC+ may delay production increases.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (4.4%) VS -25 bps (95.6%)

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which measures the greenback against a basket of six major currencies, experienced a slight retreat despite overall positive U.S. economic data. Market participants remain cautious, awaiting key events, including the U.S. election and the upcoming Nonfarm Payrolls report. Recent economic indicators mostly surpassed expectations. According to the Bureau of Economic Analysis, the U.S. Core PCE Price Index aligned with market forecasts at 2.70%, while U.S. Initial Jobless Claims dropped to 216K, beating the anticipated 229K. Moving forward, investors are advised to closely monitor upcoming employment reports to assess potential dollar movements.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 39, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 104.20, 104.60

Support level: 103.85, 103.45

Gold prices saw a notable pullback amid positive U.S. economic data, prompting profit-taking on gold’s recent highs. Stable inflation levels could encourage the Federal Reserve to adopt a more balanced monetary approach, decreasing the appeal for non-yielding assets like gold. Additionally, rising yields on UK and Japanese Treasuries increase the attractiveness of cash holdings over gold. However, long-term support for gold may persist due to potential volatility around U.S. economic reports and the upcoming U.S. election.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 2755.00, 2785.00

Support level: 2735.00, 2715.00

The British Pound weakened following Finance Minister Rachel Reeves’ tax-and-spend budget announcement. Her budget included significant tax increases aimed at addressing public service deficits, raising concerns about the potential drag on UK economic growth. Consequently, UK government bonds experienced a sell-off, with two-year gilt yields climbing by over 20 basis points. This trend reflects growing pessimism about the UK’s economic outlook, limiting demand for the Pound

GBP/USD is trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.2940, 1.3005

Support level: 1.2815, 1.2680

The Euro gained on the back of favorable inflation data from the Eurozone. The Eurozone Consumer Price Index (CPI) rose from 1.70% to 2.0%, exceeding expectations of 1.90%. The rise in inflation may reduce the likelihood of aggressive rate cuts from the European Central Bank, further supporting Euro demand.

EUR/USD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 58, suggesting the pair might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 1.0890, 1.0950

Support level: 1.0813, 1.0765

Following a recent rally, Bitcoin reached $73,000, nearing its all-time high of $73,750 recorded in mid-March. The profit-taking phase coincided with the release of the Fed’s key inflation rate, which came in at 2.1% in September, aligning with the target. Lower inflation could hint at looser Fed policy, a positive signal for crypto investors. However, elevated inflation rates continue to pose challenges for risk assets, including cryptocurrencies, as they may prompt tighter monetary policies.

BTC/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the crypto might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 72605.00, 75000.00

Support level: 66490.00, 64610.00

US. equity markets experienced a slight decline, pressured by disappointing earnings reports. Meta Platforms (NASDAQ) dropped over 4% due to lower-than-expected user growth and elevated spending forecasts, overshadowing its revenue beat. Microsoft (NASDAQ) also fell nearly 6% following cautious guidance that dampened investor sentiment, despite surpassing Q1 earnings expectations.

Nasdaq is trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 37, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 20575.00, 21075.00

Support level: 19705.00, 19120.00

The Japanese yen strengthened slightly as the Bank of Japan’s (BoJ) recent monetary policy announcement was less dovish than anticipated. The BoJ kept interest rates unchanged but noted that risks related to the U.S. economy are subsiding, suggesting a potential shift toward rate hikes in the future. Governor Kazuo Ueda’s commentary implied less caution compared to previous statements, which may signal a gradual path to monetary tightening.

USD/JPY is trading lower while currently testing the support level. MACD has illustrated increasing bullish momentum, while RSI is at 43, suggesting the pair might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 153.55, 154.85

Support level: 151.90, 149.10

Oil prices edged higher in early Asian trading following reports of potential Iranian attacks on Israel from Iraqi territory. Reports indicate Iran may utilise drones and ballistic missiles from Iraq, escalating geopolitical risks. Furthermore, speculation about OPEC+ potentially delaying a planned production increase in December is providing additional support, reflecting concerns about sluggish global demand and increasing supply levels.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 72.60, 74.75

Support level: 68.45, 67.10

Traden Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Tradingbedingungen

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!