App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

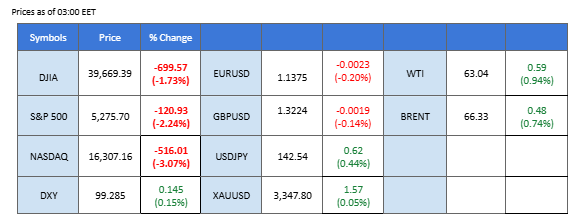

Marktübersicht

Global markets remained under pressure as escalating trade tensions between the US and China fueled investor anxiety, sending gold prices to fresh record highs. The US recently imposed a steep 145% tariff on Chinese imports, with limited exemptions for smartphones, while China retaliated with a 125% tariff on American goods. The White House further warned that total levies on some Chinese products could soar to 245% once existing duties are included. This intensifying trade war has raised concerns about stagflation, with Fed Chair Jerome Powell highlighting that tariffs are likely to drive inflation higher, yet current economic conditions do not justify a rate cut.

US equity markets fell sharply, reflecting fragile investor sentiment amid mounting fears of slowing economic growth and rising input costs. With the Fed maintaining a cautious stance and signaling no immediate plans for rate cuts, businesses may continue to struggle under the weight of higher material and borrowing costs. As company profit margins come under pressure, the outlook for US equities remains clouded by uncertainty, with stagflation risks denting investor confidence.

Meanwhile, the Japanese yen edged higher after constructive trade talks between the US and Japan, with Prime Minister Shigeru Ishiba emphasizing Japan’s prioritization of negotiations—an early sign of potential progress amid global trade friction.

Aktuelle Wetten auf eine Zinserhöhung 7th May Fed interest rate decision:

Quelle: CME Fedwatch Tool

0 bps (81.6%) VS -25 bps (18.4%)

Marktübersicht

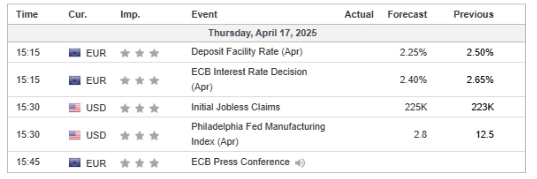

Wirtschaftskalender

(MT4 Systemzeit)

Quelle: MQL5

Marktbewegungen

The Dollar Index remained flat, continuing to consolidate in a narrow range amid mixed market sentiment. On one hand, the Fed’s reluctance to cut rates and concerns over inflation support the dollar. On the other, fears of economic slowdown and prolonged trade tensions cap its upside. Powell’s warning about stagflation risk and tariff-driven inflation has complicated the Fed’s policy path, adding uncertainty to dollar direction in the medium term.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 29, suggesting the index might enter oversold territory.

Resistance level: 101.95, 104.65

Support level: 99.25, 97.80

Gold prices hit a new record high, driven by escalating U.S.-China trade tensions and rising stagflation fears. President Trump imposed a fresh 145% tariff on Chinese goods, with some exemptions for smartphones, while China retaliated with tariffs of up to 125%. The White House noted total levies could reach 245% on select items. Fed Chair Jerome Powell added to market anxiety, warning that tariffs could fuel inflation but reiterated that cutting rates now may worsen stagflation. Amid this uncertainty, investors are flocking to gold as a safe-haven, seeking protection from inflation and economic slowdowns.

Gold prices are trading higher after successfully breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the commodity might enter overbought territory.

Resistance level: 3380.00, 3490.00

Support level: 3290.00, 3220.00

The pound edged lower following weaker-than-expected CPI data, with headline UK inflation rising only 2.6% YoY (vs. 2.7% expected). The data reignited concerns over the UK’s economic health amid ongoing global trade uncertainties. As inflation softens and broader growth risks increase, investor confidence in the pound remains shaky, especially without clearer direction from the Bank of England.

GBP/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 60, suggesting the pair might extend its losses after breakout since the RSI retreated from overbought territory.

Resistance level: 1.3315, 1.3425

Support level: 1.3195, 1.3085

The loonie firmed modestly after the Bank of Canada held interest rates steady at 2.75%, in line with expectations. This marks the BoC’s first pause after seven consecutive cuts, reflecting a cautious approach. The central bank emphasized the need for more data to assess the full impact of global tariffs and remains ready to act if inflation moves beyond control. For now, its neutral tone offered some short-term support for CAD.

USD/CAD is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 34, suggesting the pair might enter oversold territory.

Resistance level: 1.4140, 1.4440

Support level: 1.3855, 1.3600

The U.S. equity market came under pressure, posting a steep decline as investors digested both rising trade risks and a dimming economic outlook. With the Fed holding back on rate cuts, and inflationary pressures mounting, fears of stagflation are building. Corporate profit margins are under threat, weighed down by higher input costs and elevated borrowing rates, reducing investor appetite for equities in the near term.

The Dow is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 42, suggesting the dow might extend its losses since the RSI stays below the midline.

Resistance level: 40020.00, 41735.00

Support level: 38040.00, 36305.00

The Japanese yen gained modestly, buoyed by its safe-haven status and optimism over U.S.-Japan trade negotiations. Japan’s PM Shigeru Ishiba said talks were “constructive,” and President Trump confirmed “big progress” in discussions with a Japanese delegation. Japan is among the first to enter formal negotiations, marking an early test of Washington’s willingness to ease tariffs. Despite ongoing global uncertainty, BOJ’s longer-term hawkish tone continues to offer underlying support for the yen.

USD/JPY is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 33, suggesting the pair might enter oversold territory.

Resistance level: 144.15, 147.40

Support level: 140.65, 137.45

Crude oil prices rebounded slightly, helped by China’s better-than-expected GDP growth of 5.4% (vs. 5.2% forecast), signaling resilience in global demand. However, gains were limited by a bearish U.S. inventory report, with crude stocks rising by 0.515M barrels—more than the expected 0.400M—according to EIA data. While supply-side concerns persist, the broader economic uncertainty tied to trade wars remains a drag on oil’s upside potential.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 56, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 62.50, 64.45

Support level: 59.75, 57.00

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!