App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

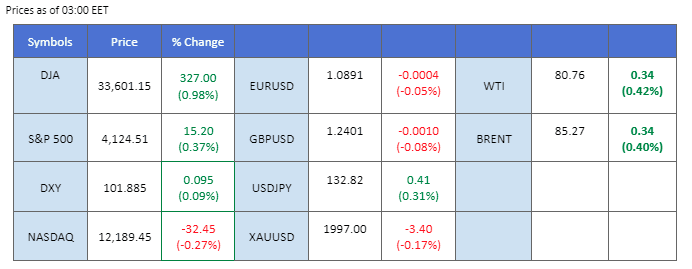

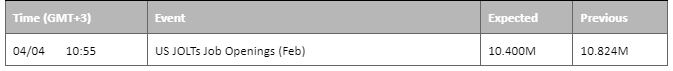

U.S. equity markets continue to be bullish, with market sentiment continuing upwards after the banking sector woes. Asian markets saw mixed performance due to inflationary worry after a surprise move from OPEC+. The oil cartel further cut production by more than 1 million barrels per day, causing oil prices to buoy above $80. The motive behind this unpredicted move, perhaps, is to drive oil short-sellers out from the trading floor. On the other hand, all eyes are on Australia’s central banks today with its interest rate decision. The Aussie dollar gained around 1.5% last night against the U.S. dollar ahead of the decision announcement, with the markets anticipating a rate hike pause from the RBA as the latest Australian economic data showed that the inflation rate in the country is slowing down.

Aktuelle Wetten auf eine Zinserhöhung 3. Mai Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (41.9%) VS 25 bps (58.1%)

The US dollar took a sharp hit amidst lacklustre economic data emanating from the US, tempering market enthusiasm regarding the possibility of an increase in interest rates by the Federal Reserve. The manufacturing sector experienced a considerable decline in March, with a key metric reaching its lowest level since May 2020, as fresh orders and employment indicators dwindled. The Institute for Supply Management’s Purchasing Managers Index (PMI) for US manufacturing fell to 46.3, below market expectations of 47.5 and worse than the previous reading of 47.7.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the index might extend its losses after successfully breakout below the support level since the RSI stays below the midline.

Resistance level: 102.90, 103.50

Unterstützungsniveau: 101,95, 100,85

Gold prices experienced a robust surge amid a weakening US Dollar, prompted by declining US Treasury yields as a crucial indicator of US factory activity demonstrated a more significant contraction than expected, thereby reducing the odds for a tighter monetary policy. The Institute for Supply Management’s Purchasing Managers Index (PMI) for US manufacturing fell to 46.3, below market expectations of 47.5 and worse than the previous reading of 47.7.

Gold prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 2000.00, 2020.00

Support level: 1950.00, 1910.00

The euro turned around and regained what it lost in Monday’s session due to the dollar plummet last night. The dollar surged the day before due to a surge in oil prices, and markets expect the Fed may be more Hawkish in monetary policy to counter the potential increase in inflation with expensive oil prices. However, yesterday the dollar hammered by the weak manufacturing PMI data came at 46.3 which is lower than the market expectation of 47.5. The pair might experience choppy price movement at least before the Non-Farm payroll is released on Friday (7th April).

The indicators depict a neutral bullish-bias signal for the pair as the RSI moves toward the overbought zone with a weak momentum while the MACD hovers close to the zero line.

Widerstandsniveau: 1,0867, 1,0917

Unterstützungsniveau: 1,0698, 1,0613

The Nasdaq dropped 0.27% to 12189 points on Monday, mainly weighed down by Tesla Inc (TSLA.O), which fell 6.1% after releasing its March-quarter deliveries increased by just 4% from the previous quarter. However, the prospect of OPEC+’s decision to cut production has driven up the oil prices and added inflation risks as traders raised expectations that the U.S. Federal Reserve might increase another quarter point in May.

As for now, the index is likely to trade on the sidelines as market uncertainty increases. On the technical front, the index manages to stand firm above the support level of 11993 points as of writing. It could form an upward trend ahead of the current support level. Moreover, MACD is illustrating an increasing bullish momentum ahead. RSI is at 66, which also indicates a bullish momentum ahead.

Resistance level: 12523, 13013

Support level: 11993, 10778

The Pound Sterling rose 1.05% to $1.2405 against the weakened dollar on Monday as the U.S. ISM manufacturing PMI data showed a worse-than-expected reading of 46.3, which failed to meet the market expectation of 47.5. In addition, many economists predict that the Bank of England is still hiking, but it is near the end of its hiking cycle. The overall performance of the pound is the best among currencies, which is surprising because the economic backdrop is not exciting. As for now, attention is staying on the BoE’s rate and the UK’s economic outlook. More data will be released tomorrow, including UK’s composite PMI and Services PMI.

The pound is hovering within the range of 1.2298 to 1.2425 as of writing. The $1.2425 is a crucial resistance level as the price was already tested twice last month. Investors should focus on this psychological level and monitor for the potential break above. If it can spike up, we could expect a bullish trend ahead. MACD illustrates a neutral-bullish momentum. RSI is at 59, which indicates a neutral-bullish momentum ahead.

Widerstandsniveau: 1,2425, 1,2613

Unterstützungsniveau: 1,2298, 1,2190

The US stock market recorded gains on Monday, buoyed by an upswing in energy stocks, following surprise cuts to the OPEC+ group’s oil output targets, which set off a bullish surge in oil prices. Chevron Corp, Exxon Mobil Corp and Occidental Petroleum Corp were among the biggest beneficiaries, with all three firms rallying more than 4%. US Treasury yields experienced a decline as a crucial indicator of US factory activity exhibited a more significant contraction than expected, thereby reducing the odds for a tighter monetary policy.

The Dow is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, RSI is at 63, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 34310.00, 35640.00

Unterstützungsniveau: 32875,00, 31600,00

Crude oil prices remained elevated on Monday, extending their gains, and hovering near recent highs as investors continued to digest the implications of the massive production cuts announced by OPEC+ over the weekend. The decision by the Organization of the Petroleum Exporting Countries and its allies, including Russia, to lower their production target by an additional 1.16 million barrels per day (bpd) came as a surprise to the markets and sent shockwaves through the industry. With this latest move, the total volume of cuts by OPEC+ now stands at a staggering 3.66 million bpd, including the 2-million-barrel cuts implemented last October, according to Reuters’ calculations.

Oil prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 80, suggesting the commodity might enter overbought territory.

Resistance level: 80.75, 85.45

Unterstützungsniveau: 77,25, 73,80

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!