App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

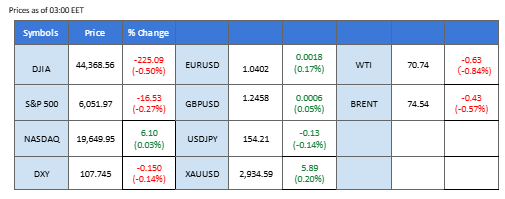

Marktübersicht

Investors remained focused on the U.S. CPI data after Federal Reserve Chair Jerome Powell reinforced a hawkish outlook in his testimony on Tuesday, emphasizing the central bank’s commitment to maintaining restrictive monetary policy amid strong economic performance. The dollar initially strengthened as inflation came in at 3%, prompting Powell to reiterate that the Fed still has work to do in curbing inflationary pressures.

Später gab der Dollar jedoch nach, als sich die Marktstimmung auf geopolitische Entwicklungen verlagerte. Der ehemalige US-Präsident Donald Trump forderte den russischen Präsidenten Wladimir Putin auf, über ein Ende des Konflikts zwischen Russland und der Ukraine zu verhandeln, was den Optimismus für eine mögliche Lösung schürte. Die Aussicht auf eine Deeskalation unterstützte den Euro und das Pfund Sterling, während die Ölpreise ihre Gewinne vom Wochenanfang wieder aufgaben und aufgrund des geringeren geopolitischen Risikos um fast 3% sanken.

Mit Blick auf die Zukunft werden Händler ihre Aufmerksamkeit auf den BIP-Bericht des Vereinigten Königreichs richten, der die Richtung des Pfund Sterling angesichts seines jüngsten Mangels an Schwung beeinflussen könnte. In der Zwischenzeit fanden Bitcoin (BTC) und Ethereum (ETH) Unterstützung, nachdem sie neue Wochentiefs erreicht hatten und in der vorangegangenen Sitzung einen technischen Aufschwung erlebten.

Aktuelle Wetten auf eine Zinserhöhung 19. März Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (91,50%) VS -25 bps (8,5%)

Marktübersicht

Wirtschaftskalender

(MT4 Systemzeit)

Quelle: MQL5

Marktbewegungen

The release of crucial US Consumer Price Index (CPI) data kept markets on edge. According to the US Bureau of Labor Statistics, the annual CPI came in at 3.0%, surpassing economists’ expectations of 2.9%. The dollar index initially surged following the hotter-than-expected CPI report but later retreated as investors engaged in profit-taking ahead of market uncertainties. This week, Trump approved 25% tariffs on steel and aluminum imports and hinted at reciprocal tariffs against key US trading partners, adding further uncertainty to the US economic outlook.

Der Dollar-Index handelt nach dem vorangegangenen Retracement von der Widerstandsmarke schwächer. Der MACD zeigt ein zunehmendes rückläufiges Momentum, während der RSI bei 43 liegt, was darauf schließen lässt, dass der Index seine Verluste ausweiten könnte, da der RSI unter der Mittellinie bleibt.

Widerstandsniveau: 108,40, 109,90

Unterstützungsniveau: 107,35, 106,50

Gold prices held near record highs as traders balanced hot US inflation data against rising safe-haven demand amid escalating trade tensions. Initially, gold dipped following the CPI release, as traders priced in fewer Fed rate cuts. However, uncertainty surrounding Trump’s aggressive tariff plans continued to fuel demand for the precious metal.

Der Goldpreis handelt nach der vorherigen Erholung von der Unterstützungsmarke höher. Der MACD zeigt ein abnehmendes rückläufiges Momentum, während der RSI bei 61 liegt, was darauf hindeutet, dass der Rohstoff seine Gewinne ausbauen könnte, da der RSI über der Mittellinie bleibt.

Widerstandsniveau: 2935,00, 2960,00

Unterstützungsniveau: 2875,00, 2815,00

Das Währungspaar GBP/USD geriet zunächst unter Abwärtsdruck, nachdem die US-Inflationsdaten besser als erwartet ausgefallen waren und den Dollar stärkten. Die Stimmung schlug jedoch um, nachdem berichtet wurde, dass der ehemalige Präsident Donald Trump den russischen Präsidenten Wladimir Putin aufgefordert hatte, Schritte zur Lösung des anhaltenden Konflikts in der Ukraine zu unternehmen. Die Aussicht auf eine Deeskalation in der Region stärkte das Vertrauen der Märkte und gab dem Pfund Sterling Unterstützung. Händler blicken heute auf die Veröffentlichung des britischen Bruttoinlandsprodukts, das einen direkten Einfluss auf das Währungspaar haben könnte.

GBP/USD remains flirting at its weekly high after the pair dipped and recovered in yesterday’s session. This suggests the pair has strong support below the 1.2430 mark. Both the RSI and MACD have been hovering in the middle region, suggesting a neutral signal for the pair.

Widerstandsniveau: 1,2610, 1,2730

Unterstützungsniveau: 1,2375, 1,2300

EUR/USD hat seinen langfristigen Abwärtstrend-Widerstand überwunden und signalisiert damit eine mögliche Verschiebung des Momentums. Sollte sich das Paar oberhalb dieser Schwelle halten, könnte dies einen zinsbullischen Ausbruch bestätigen. Der Euro gewann an Zugkraft, nachdem der ehemalige US-Präsident Donald Trump, der als Vermittler für die Ukraine auftrat, den russischen Präsidenten Wladimir Putin zu Gesprächen zur Beendigung des anhaltenden Konflikts gedrängt haben soll. Die Hoffnung auf eine geopolitische Deeskalation hat die Marktstimmung gestärkt und die Gemeinschaftswährung unterstützt.

EUR/USD hat den Abwärtstrend-Widerstand überwunden, was auf eine zinsbullische Tendenz für dieses Paar hindeutet. Der RSI steigt weiter an, während der MACD kurz davor steht, die Nulllinie zu durchbrechen, was darauf hindeutet, dass sich ein zinsbullisches Momentum bilden könnte.

Widerstandsniveau: 1,0460, 1,0595

Unterstützungsniveau: 1,0353, 1,0260

The USD/JPY pair has surged toward the key 154.00 level, where strong resistance may limit further upside. Market sentiment toward the yen shifted after Japan’s Producer Price Index (PPI) hit its highest level since July 2023, exceeding 4%. The strong inflation print reinforced speculation that the Bank of Japan (BoJ) may raise rates in March, a move that could strengthen the yen in the near term.

USD/JPY hat seit Anfang der Woche um fast 2% zugelegt, was auf eine zinsbullische Trendwende bei dieser Paarung hindeutet. Der RSI ist in den überkauften Bereich vorgedrungen, während der MACD die Nulllinie nach oben durchbrochen hat, was darauf hindeutet, dass das Paar nun mit zinsbullischem Momentum handelt.

Widerstandsniveau: 156,25, 158,14

Unterstützungsniveau: 152,00, 149,30

Der Nasdaq beendete die Sitzung unverändert, da die US-Aktien aufgrund gemischter Marktsignale weiterhin um eine klare Richtung rangen. Auf der Abwärtsseite trieben stärker als erwartet ausgefallene Daten zum Verbraucherpreisindex in den USA die Renditen von Staatsanleihen in die Höhe und setzten den breiteren Aktienmarkt unter Druck. Der Optimismus im Zusammenhang mit dem Wachstum des Technologiesektors und den Fortschritten der künstlichen Intelligenz sorgte jedoch für einen Puffer, so dass sich der Nasdaq trotz der allgemeinen Marktunsicherheit stabil halten konnte.

Der Nasdaq wird höher gehandelt und testet derzeit die Widerstandsmarke. Der MACD zeigt jedoch ein abnehmendes zinsbullisches Momentum, während der RSI aus dem überkauften Bereich zurückkehrte, was darauf hindeutet, dass der Index zu einer bärischeren Front neigen und seinen Konsolidierungstrend ausweiten könnte.

Widerstandsniveau: 21920,00, 22590,00

Unterstützungsniveau: 21065,00, 20590,00

Bitcoin (BTC) hat sich stark erholt und ist über 3,5% gestiegen, nachdem er sich in der Nähe der Marke von $94.200 Liquidität verschafft hatte, wo in der letzten Sitzung eine beträchtliche Anzahl von Long-Kontrakten liquidiert wurde. Der starke Anstieg deutet auf eine potenzielle Trendwende hin, bei der BTC frühere Höchststände zurückerobern könnte. Die allgemeine Risikostimmung verbesserte sich, nachdem Präsident Trump die Initiative zur Lösung des anhaltenden Konflikts in Osteuropa ergriffen hatte, was die geopolitischen Spannungen abschwächte und die Nachfrage nach Risikoanlagen, einschließlich Kryptowährungen, ankurbelte.

BTC bewegt sich weiterhin seitwärts und handelt in einer breiten Spanne, was ein neutrales Signal für BTC darstellt. Allerdings hat der RSI mit der 50er-Marke geflirtet, während der MACD kurz davor steht, die Nulllinie zu durchbrechen, was darauf hindeutet, dass das Abwärtsmomentum verschwindet und es zu einer technischen Erholung kommen könnte.

Widerstandsniveau: 99920,00, 103160,00

Unterstützungsniveau: 96400,00, 92160,00

Die Rohölpreise gingen leicht zurück, nachdem der EIA-Bericht über die US-Lagerbestände die Erwartungen übertroffen hatte. Nach Angaben der Energy Information Administration (EIA) stiegen die US-Rohöllagerbestände um 4,07 Mio. Barrel und übertrafen damit die Markterwartungen von 2,4 Mio. Barrel, was auf eine schwache Nachfrage hindeutet. In der Zwischenzeit erklärte Trump, dass er auf ein Waffenstillstandsabkommen zwischen Russland und der Ukraine drängen werde, was die Versorgungsunterbrechungen verringern und die Ölpreise weiter unter Druck setzen könnte.

Die Rohölpreise notieren niedriger und testen derzeit die Unterstützungsmarke. Der MACD zeigt ein zunehmendes rückläufiges Momentum, während der RSI bei 33 liegt, was darauf hindeutet, dass der Rohstoff seine Verluste ausweiten könnte, da der RSI unter der Mittellinie bleibt.

Widerstandsniveau: 73,30, 75,25

Unterstützungsniveau: 70,40, 67,80

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!