App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web-Händler

- PU Soziales

App herunterladen

Japan’s Core Consumer Price Index (CPI) data exceeded market expectations at 2%, strengthening the Japanese Yen against other major currencies.

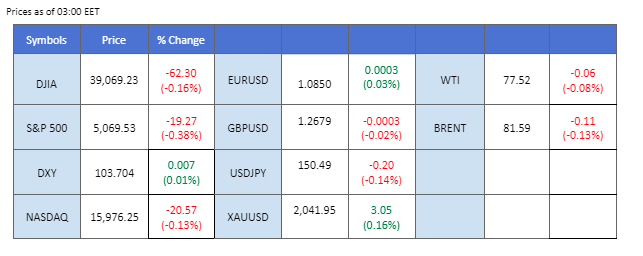

The bullish momentum in U.S. equity markets appears to be tapering off, trading flat in anticipation of the crucial U.S. Personal Consumption Expenditures (PCE) reading. This data is poised to influence market perceptions regarding the upcoming monetary policy decisions from the Federal Reserve, thereby impacting overall risk sentiment. Concurrently, the U.S. long-term Treasury yield has remained around the 4.3% mark, while the Dollar Index (DXY) shows lacklustre movement as traders position themselves ahead of Thursday’s PCE release. In contrast, Japan’s just-released Core Consumer Price Index (CPI) data exceeded market expectations at 2%, strengthening the Japanese Yen against other major currencies. Furthermore, Bitcoin (BTC) has reached its highest level in two years, surpassing $56,000, following news that software company MicroStrategy purchased 3,000 units of Bitcoin, instigating increased buying sentiment in the cryptocurrency market.

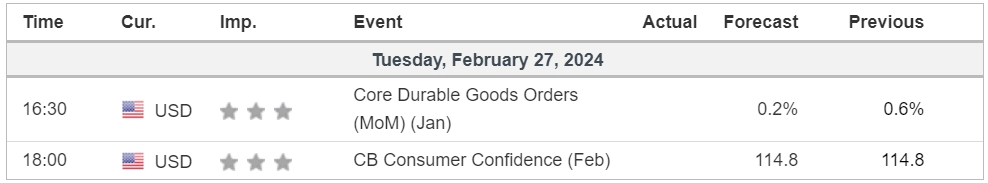

Aktuelle Wetten auf eine Zinserhöhung 20. März Zinsentscheidung der Fed:

Quelle: CME Fedwatch Tool

0 bps (89,5%) VS -25 bps (10,5%)

(MT4 Systemzeit)

Quelle: MQL5

The Dollar index encounters bearish headwinds as downbeat economic data, particularly a disappointing US New Home Sales figure of 661K (below the expected 680K), prompts market concern. Investors now pivot their attention to pivotal economic indicators, notably January’s Personal Consumption Expenditures Price Index (PCE) — a key metric for the Federal Reserve — adding an element of suspense to the unfolding narrative. Additionally, the imminent release of US GDP data later in the week promises to inject further complexity into the market outlook.

The Dollar Index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 43, suggesting the index might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 104.50, 104.95

Unterstützungsniveau: 103,85, 103,05

Gold prices stage a modest recovery, capitalising on a weakening US Dollar post lacklustre home sales data. Despite this positive momentum, the overall short-term trajectory for the gold market remains in a state of flux. Investors maintain a cautious stance, patiently awaiting critical US economic data, including US GDP and the US Core PCE report.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 56, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Widerstandsniveau: 2035,00, 2060,00

Unterstützungsniveau: 2015,00, 1985,00

The GBP/USD currency pair has consistently stayed within its upward trend channel, with the dollar exhibiting subdued performance. Attention is now sharply focused on key upcoming U.S. economic indicators. The Gross Domestic Product (GDP) data set for release tomorrow is highly anticipated, along with the Personal Consumption Expenditures (PCE) index, scheduled for Thursday. These pivotal reports are expected to offer critical insights into the direction of the Federal Reserve’s monetary policy decisions and provide a clearer picture of the dollar’s strength in the near term.

GBP/USD remain trading in its uptrend channel, suggesting a bullish bias for the pair. The RSI remains in the upper region while the MACD has been moving up, suggesting the bullish momentum remains strong.

Widerstandsniveau: 1,2710, 1,2785

Unterstützungsniveau:1,2635, 1,2530

The EUR/USD pair is advancing, capitalising on a weakening U.S. dollar, though it now encounters significant resistance at the proximal 1.0866 level. Emerging signs of an acceleration in Eurozone inflation, underscored by a marginally higher Consumer Price Index (CPI) alongside enhanced Purchasing Managers’ Index (PMI) figures, imply a fortification of the European economic landscape, thereby underpinning the Euro’s valour. A forthcoming address by European Central Bank (ECB) President Christine Lagarde stands as a potentially critical determinant for the currency pair’s trajectory in the near term.

EUR/USD has eased from its bullish trend and is facing a strong resistance level at near 1.0866. The MACD flows flat above the zero line while the RSI hovering near the overbought zone suggests the bullish momentum remains intact with the pair.

Widerstandsniveau: 1,0865, 1,0954

Unterstützungsniveau: 1,0775, 1,0770

Following a historic market high buoyed by positive sentiments surrounding Artificial Intelligence and a stellar performance by Nvidia, the US equity market experiences a deceleration. Federal Reserve officials indicate a possible delay in rate cuts, injecting an air of caution among investors. The anticipation of a protracted period of higher interest rates casts a shadow on market sentiment. The spotlight now shifts to imminent economic data releases, with Thursday’s Core PCE Price Index emerging as a pivotal event likely to shape market dynamics

Nasdaq is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 58, suggesting the index might experience technical correction since the RSI stays above the midline.

Widerstandsniveau: 18150,00, 19255,00

Unterstützungsniveau: 17280,00, 16670,00

The Japanese Yen exhibited strength during the opening session of the Asian market, successfully maintaining a position below the crucial 150.75 mark. The unexpected resilience may be attributed to the recently released Japanese National Core CPI, which surpassed market expectations by reaching 2%. This positive economic data has served as a catalyst for the Yen, which has struggled in the face of recent lacklustre performance. The pair is anticipated to be influenced by key events, including tomorrow’s U.S. GDP data and Thursday’s release of the U.S. PCE, as the Japanese Yen contends with its weakened state against the dollar.

The pair face strong resistance at near 150.75 levels. The RSI remains at elevated levels while the MACD flowing flat above the zero line suggests the bullish momentum is easing.

Widerstandsniveau: 151,85, 154,90

Unterstützungsniveau: 149,50, 147,60

Oil prices witness a robust rebound fueled by persistent shipping disruptions, notably in the Red Sea due to activities linked to Iran-aligned Houthi rebels. Geopolitical tensions in the Middle East continue to underscore concerns, creating a volatile backdrop for oil markets. Despite ongoing ceasefire talks, the lack of substantial progress amplifies fears of potential disruptions in the oil supply chain, further contributing to upward pressure on oil prices.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Widerstandsniveau: 78,65, 81,20

Unterstützungsniveau: 75,20, 71,35

Handeln Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Handelsbedingungen

Bitte beachten Sie, dass die Website für Personen bestimmt ist, die in Ländern ansässig sind, in denen der Zugriff auf die Website gesetzlich zulässig ist.

Bitte beachten Sie, dass PU Prime und die mit ihr verbundenen Unternehmen nicht in Ihrem Heimatland ansässig oder tätig sind.

Indem Sie auf die Schaltfläche "Bestätigen" klicken, bestätigen Sie, dass Sie diese Website ausschließlich aus eigener Initiative und nicht als Ergebnis einer speziellen Marketingaktion besuchen. Sie möchten Informationen von dieser Website erhalten, die auf umgekehrte Weise in Übereinstimmung mit den Gesetzen Ihres Heimatlandes zur Verfügung gestellt werden.

Vielen Dank für Ihre Rückmeldung!

Beachten Sie, dass die Website für Personen bestimmt ist, die in Rechtsgebieten wohnen, in denen der Zugang zur Website nach dem Gesetz erlaubt ist.

Beachten Sie, dass PU Prime und seine Tochtergesellschaften nicht in Ihrem Heimatland ansässig sind und nicht in Ihrem Land arbeiten.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Vielen Dank für Ihre Rückmeldung!