App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

App herunterladen

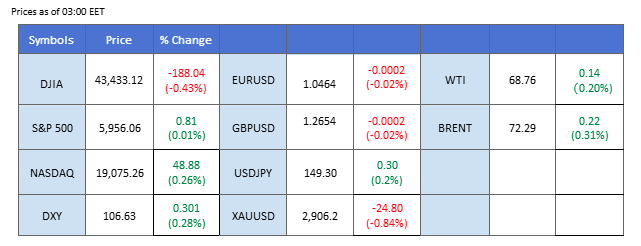

Market Summary

The market had its attention on Nvidia’s earnings report, which was released after market close. The company’s optimistic forecast fueled a strong post-market rally in its share price, potentially setting the stage for a broader rebound in the U.S. equity market. Investors are now awaiting today’s U.S. GDP data, which could provide further direction. While Wall Street has remained subdued and largely directionless, the Hang Seng Index (HSI) has shown strong bullish momentum, breaking above the 24,000 mark for the first time since 2022, signaling renewed investor confidence in Chinese equities.

In the foreign exchange market, the U.S. dollar continues to struggle, pressured by lackluster U.S. Treasury yields and fading investor confidence. The dollar index remains below the key 107.0 level, reinforcing a bearish bias for the greenback. Meanwhile, geopolitical developments remain in focus, with Ukrainian President Zelenskyy scheduled to meet with U.S. President Trump on Friday. Any positive developments from this meeting could help ease geopolitical tensions in the region, reducing safe-haven demand for gold and oil.

In the crypto space, digital assets remain under significant selling pressure. Bitcoin has slipped to a new low below $86,000, while Ethereum has fallen to its lowest level since last October. The sector continues to face headwinds, particularly in the wake of the recent Bybit hack, which has shaken market confidence in digital asset security.

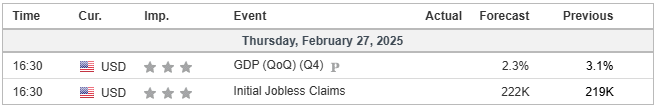

Current rate hike bets on 19th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Overview

(MT4 System Time)

Source: MQL5

Market Movements

The Dollar Index remains below its previous high and the Fair Value Gap (FVG) zone, signaling a bearish bias for the greenback. While U.S. long-term Treasury yields remain elevated, a potential decline in yields could further weigh on the dollar’s strength. Market participants are closely watching today’s U.S. GDP release, with expectations pointing toward signs of economic contraction. If the data confirms a slowdown, it could add further downside pressure on the dollar, reinforcing its current bearish trajectory.

The Dollar Index has been subduing, but it remains trading in a lower-high price pattern, suggesting a bearish bias for the pair. The RSI remains below the 50 level, but the MACD is forming a higher high, suggesting that the bearish momentum is easing.

Resistance level:107.35, 108.40

Support level: 105.50, 103.70

Gold prices have broken below the Fair Value Gap (FVG) and reached a new low in the recent session, reinforcing a bearish bias. If gold once again fails to sustain above the psychological support level of $2,900, it may continue its bearish trajectory. Meanwhile, the improving relationship between the U.S. and Russia, along with ongoing efforts to resolve the prolonged Ukraine-Russia conflict, could further reduce safe-haven demand for gold. Any positive developments on this front may accelerate gold’s decline as risk appetite strengthens in the broader financial markets.

Gold prices have slid below the critical $2900 mark after being capped at below the $2955 mark, suggesting a potential bearish trend reversal for gold. The RSI continues to slide while the MACD has gotten below the zero line, suggesting that bearish momentum is forming.

Resistance level: 2955.00, 3007.00

Support level: 2874.50, 2834.40

The GBP/USD pair edged slightly higher in the last session, extending its gains for February as the U.S. dollar continued to struggle against mounting headwinds. The greenback’s weakness has allowed the pair to push higher, with market sentiment leaning towards further upside should economic data disappoint. Investors are closely watching today’s U.S. GDP release, which is expected to come in lower than the previous reading. If the data aligns with expectations, it could reinforce the dollar’s softness and provide further support for the pound, keeping the pair on its upward trajectory.

GBP/USD remains trading in an uptrend, but the bullish momentum is seemingly decreasing, potentially causing a technical retracement ahead. The RSI remains hovering above the 50 level, but the MACD continues to edge lower, signaling that the bullish momentum is easing.

Resistance level: 1.2780, 1.2865

Support level: 1.2575, 1.2502

The EUR/USD pair struggled to break past the 1.0520 mark and edged lower, indicating a potential technical retracement. Traders should closely monitor the uptrend support level at 1.0467—if the pair falls below this threshold, it could signal a bearish shift. Meanwhile, geopolitical risks remain a key factor, as reports suggest President Trump may extend tariff measures to the eurozone following similar actions against Canada and Mexico. Any confirmation of such a move could weigh on the euro, adding further downside pressure to the pair.

EUR/USD remains trading above its uptrend support level; a break below such a level would be a bearish signal for the pair. The RSI is gradually easing while the MACD is flowing flat above the zero line, suggesting that the bullish momentum is vanishing.

Resistance level: 1.0525, 1.0596

Support level: 1.0450, 1.0385

Despite the broader weakness of the U.S. dollar against most of its peers, the USD/CAD pair has managed to climb higher from its recent lows, indicating relative weakness in the Canadian dollar. The loonie has been weighed down by concerns over potential tariffs from the Trump administration, which have dampened investor sentiment. However, with President Trump recently announcing an extension of the levy deadline to April, market participants may see a shift in sentiment. This delay could ease immediate pressure on the Canadian dollar and potentially trigger a bearish trend reversal for the USD/CAD pair in the near term.

The USDCAD pair has been trading in an uptrend after reaching its recent low at the 1.4160 mark, suggesting a bullish bias for the pair. The RSI is breaking into the overbought zone, while the MACD has broken above from the zero line, suggesting that the bullish momentum is gaining.

Resistance level: 1.4440, 1.4550

Support level: 1.4240, 1.4150

USD/JPY continues to trade along its downtrend resistance level, indicating a bearish bias for the pair. Market sentiment remains tilted in favor of the Japanese Yen after a top Japanese financial official hinted that the Bank of Japan may share a similar view on an upcoming rate hike, reinforcing expectations of a more hawkish policy stance. Meanwhile, the U.S. dollar remains under pressure, and if today’s U.S. GDP reading falls short of expectations, it could further weigh on the pair, accelerating its decline.

USD/JPY is resisting below the downtrend resistance line, which suggests a bearish bias for the pair. The RSI remains at the lower levels, while the MACD continues to flow below the zero line, suggesting that the pair remains trading with bearish momentum.

Resistance level: 151.35, 154.00

Support level: 146.95, 143.80

Oil prices have slid to a new low in the recent session, dipping below the $68.00 mark. The market is closely watching the improving relationship between President Trump and President Putin, speculating that the U.S. may soon lift sanctions on Russian oil exports. Additionally, Ukrainian President Volodymyr Zelenskyy is set to visit the White House on Friday, raising hopes for a diplomatic breakthrough that could ease the prolonged Russia-Ukraine conflict. Any positive developments on this front could further pressure oil prices, as reduced geopolitical risks may weaken the supply disruption narrative that has supported the market.

Oil prices have reached a new low since last December, suggesting a bearish bias. The RSI has slid into the oversold zone, while the MACD edged lower, suggesting that the bearish momentum is gaining.

Resistance level: 70.30, 72.70

Support level: 67.80, 65.60

Traden Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Tradingbedingungen

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!