App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

App herunterladen

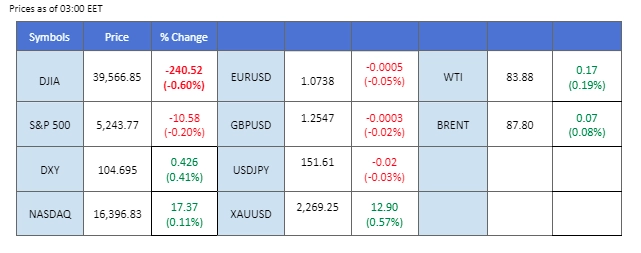

The dollar index (DXY) surged by nearly 0.5% in the previous session, propelled by the robust ISM PMI readings surpassing the 50-mark threshold, signalling sustained economic growth in the United States. Federal Reserve Chair Jerome Powell’s relatively dovish remarks last Friday, following the release of the PCE reading within expectations, fostered market anticipation of a potential rate hike in June. Meanwhile, the recently unveiled RBA meeting minutes revealed that the Reserve Bank of Australia did not entertain the notion of raising interest rates at its previous meeting. Market analysts interpret this as a signal that the RBA has concluded its rate hike cycle, dampening sentiment for the Australian dollar, particularly in the Asia market opening session.

In the commodities market, gold prices were impacted by the strengthening dollar, leading to sideways trading near all-time high levels. Conversely, oil prices continued their ascent, driven by the outlook of tightened supply and exacerbated geopolitical tensions in both European and Middle Eastern regions.

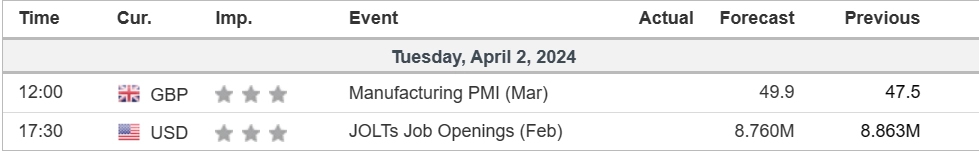

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (85.5%) VS -25 bps (14.5%)

(MT4 System Time)

Source: MQL5

The Dollar Index continued its upward trajectory against major currencies fueled by better-than-expected US economic indicators, dashing hopes for imminent rate cuts from the Federal Reserve. Surging US Treasury yields further bolstered demand for the US Dollar, reflecting market confidence in the economy’s resilience. Notably, robust readings from the ISM Manufacturing Prices and PMI added to the greenback’s strength, prompting a decline in the probabilities of rate cuts, as indicated by the CME FedWatch Tool.

The Dollar Index is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum. However, RSI is at 71, suggesting the index might enter overbought territory.

Resistance level: 104.95, 105.40

Support level:104.60, 104.00

Gold prices experienced a slight retreat as investors engaged in profit-taking activities amidst the backdrop of a stronger US Dollar. Optimistic economic data released from the US underscored the country’s positive economic outlook, prompting investors to shift their focus towards the Dollar. However, lingering geopolitical tensions in the Middle East and upcoming US elections could introduce market uncertainties, potentially limiting gold’s losses in the long term.

Gold prices are trading flat while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 57, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 2250.00, 2280.00

Support level: 2215.00, 2185.00

The Pound Sterling faced significant downward pressure against the strengthening dollar, plummeting to its lowest level since early February and approaching a critical support level at 1.2540. Amidst a lack of significant catalysts for the Sterling, the dollar gained traction following the release of upbeat PMI readings yesterday, leading to a 0.5% decline in the GBP/USD pair.

GBP/USD edged lower after a period of consolidation, suggesting a bearish bias for the pair. The RSI is on the brink of breaking into the oversold zone, while the MACD failed to break above the zero line, suggesting a fresh bearish momentum is forming.

Resistance level: 1.2660, 1.2760

Support level: 1.2540, 1.2440

The EUR/USD pair encountered selling pressure, prompted by a strengthening dollar buoyed by positive U.S. PMI data released yesterday. As inflation indicators in the Eurozone begin to show signs of moderation, market participants are now keenly awaiting today’s Eurozone PMI figures and Wednesday’s CPI data. These key economic indicators are expected to offer insights into the European Central Bank’s (ECB) forthcoming monetary policy decisions and potentially impact the euro’s performance.

EUR/USD is trading lower and is approaching its critical psychological support level at 1.0700. The MACD continues to edge lower while the RSI is on the brink of breaking into the oversold zone, suggesting the pair is trading with a bearish trajectory.

Resistance level: 1.0775, 1.0866

Support level: 1.0700, 1.0630

The Australian dollar is nearing its monthly low following the release of dovish meeting minutes from the Reserve Bank of Australia (RBA) earlier today. The minutes revealed that board members did not deliberate on further interest rate hikes in March, leading market participants to infer that the RBA may have concluded its tightening cycle. This perception has contributed to a weakening of the Australian dollar against other major currencies.

AUD/USD is testing its support level at 0.6484 with overwhelming bearish momentum. The RSI hovers in the lower region, while the MACD continues to flow below the zero line, suggesting the pair is trading with bearish momentum.

Resistance level: 0.6535, 0.6585

Support level: 0.6485, 0.6410

The Japanese yen remains lackluster, with the USD/JPY pair once again approaching the critical level near 152, which served as the intervention level for the Japanese authorities back in November 2022. Market sentiment suggests that the Bank of Japan (BoJ) will unlikely implement its next rate hike until October, contributing to the yen’s weakness.

USD/JPY remains trading within its consolidation range between 151.75 and 151.00 level. The RSI has been flowing at the upper region while the MACD is currently flowing flat above the zero line, suggesting a fresh bullish momentum might be forming.

Resistance level: 151.95, 153.10

Support level: 150.80, 149.35

The US equity market kicked off the second quarter on a challenging note as surging US Treasury yields dampened investor sentiment. A surprise expansion in manufacturing activity highlighted the economy’s strength, diminishing expectations for immediate Federal Reserve rate cuts. Despite these headwinds, the market found support from the burgeoning AI sector, with tech giants like Microsoft and Micron Technology experiencing notable gains. Microsoft’s plans to introduce standalone chat and video apps and Bank of America’s optimistic price hike on Micron Technology underscored confidence in the sector’s growth potential.

Dow Jones is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 56, suggesting the index might extend its losses toward support level since the RSI retreated sharply from overbought territory.

Resistance level: 39855.00, 40995.00

Support level: 39150.00, 37700.00

Oil prices climbed higher following reports of heightened geopolitical tensions in the Middle East, with Israel striking an Iranian consulate in Syria. These developments fueled concerns over tighter global supplies, bolstering oil prices ahead of the upcoming OPEC+ meeting. Investors eagerly anticipate the gathering, where discussions surrounding supply and demand dynamics, as well as adherence to output cuts, are expected to influence market sentiment.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 74, suggesting the commodity might experience technical correction since the RSI entered the overbought territory.

Resistance level: 85.45, 89.10

Support level: 83.15, 80.20

Traden Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Tradingbedingungen

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!