App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

App herunterladen

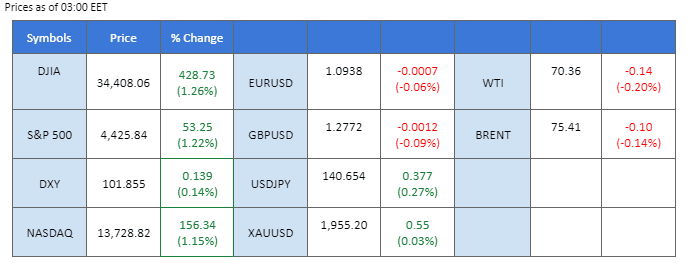

Following the Federal Reserve’s decision to maintain the interest rate unchanged, equity markets responded positively, leading to upward movements, while the U.S. dollar experienced a significant decline of nearly 1% last night. On the other hand, Asian equities continue to gain, helped by the expectation of more stimulus from China. On top of that, oil prices have jumped nearly 3% last night, boosted by the Chinese loosening monetary policy as well. Elsewhere, the Japanese Yen recovered all its losses against the USD ahead of the BoJ interest rate decision. However, the market is expecting no change in monetary policy from the BoJ and potentially exerting selling pressure on the Japanese Yen in the market.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (28%) VS 25 bps (72%)

US Dollar slumped amid a string of lacklustre economic data. US Treasury yields took a step back as investors speculated on the potential end of the tightening monetary cycle. Despite the Federal Reserve’s warnings of a 50-basis point rate increase in 2023, the downbeat economic indicators prompted market participants to reassess the likelihood of such a move. The Department of Labor reported that US Initial Jobless Claims came in worse than expected at 262K, while the Philadelphia Fed Manufacturing Index for the previous month also fell short of market expectations.

The dollar index is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum. However, RSI is at 29, suggesting the index might enter oversold territory.

Resistance level: 103.30, 103.90

Support level: 102.70, 102.00

Gold prices saw a significant increase following the release of initial jobless claims, which showed a higher figure of 262,000 compared to the market expectation of 250,000. The rise in gold prices can be attributed to the perception that weaker-than-expected jobless claims indicate a potential economic slowdown. Investors often view a weaker economy as a signal for potential economic uncertainties and seek the safe-haven appeal of gold as a store of value. The unexpected increase in jobless claims may have raised concerns about the overall economic health, leading investors to flock towards gold as a hedge against potential risks and uncertainties.

The recent price action in gold revealed a bear trap or false break below a key support level, followed by a rebound. This pattern suggests that the downward momentum was short-lived, and the potential for continuing the existing trend is likely.

Resistance level: 1980.00, 2005.00

Support level: 1940.00, 1915.00

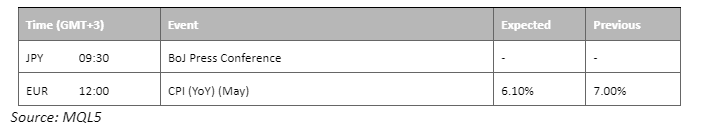

Euro surged following the European Central Bank (ECB) extending its tightening monetary decisions. In a decisive monetary decision, European Central Bank (ECB) President Christine Lagarde struck a hawkish tone, indicating the central bank’s intent to continue raising interest rates in July. The ECB’s announcement of a 25-basis point rate hike during the June policy meeting resulted in a surge in the Euro, which gained significant strength against other major currencies. The interest rate adjustment elevated the Euro interest rate from 3.75% to 4.00%, underscoring the ECB’s commitment to managing inflationary pressures and maintaining a stable economic environment.

EUR/USD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 74, suggesting the pair might enter overbought territory.

Resistance level: 1.0960, 1.1055

Support level: 1.0895, 1.0820

The USD/JPY pair experienced a decline from its highest level since last December ahead of the BoJ interest rate decision on Friday (16th June). The weakening of the dollar due to the interest rate decision from the Fed last night provides some breathing space for the Yen as the Yen has lost more than 10% against the USD in 2023. It is widely expected that the Japanese central bank will keep its monetary policy unchanged and the Yen may continue to face selling pressure in the market.

USD/JPY has touched the 141 level for the first time since last December. The RSI and the MACD continue to move higher suggesting the pair is trading in a bullish momentum.

Resistance level: 141.90, 143.20

Support level: 139.20, 137.70

The pound reached a 14-month high in early trading, demonstrating significant strength and resilience against the US dollar. This surge in value reflects positive market sentiment and increased confidence in the UK currency. The pound’s upward trajectory has been bolstered by several factors, including expectations of future interest rate hikes in the UK following encouraging jobs data. Additionally, the Bank of England’s commitment to reviewing its economic forecasting methods has strengthened the pound’s position. Investors and traders closely monitor these developments as the pound continues to outperform the US dollar, reaching its highest level in over a year.

The RSI has entered the overbought zone, indicating a potential cautionary signal for market participants as it suggests a possible technical correction in the near term. However, the MACD indicator portrays a strong bullish momentum, adding to the overall positive sentiment in the market. Traders and investors should closely monitor the RSI levels and be prepared for potential market adjustments while considering the continued bullish momentum indicated by the MACD.

Resistance level: 1.2800, 1.2979

Support level: 1.2647, 1.2573

The Dow extended their bullish momentum following the retreat in US Treasury yields. The more dovish expectations regarding the Federal Reserve’s rate hike decisions prompted investors to adopt a positive outlook on the equity market. Amid a string of lacklustre economic data, US Treasury yields took a step back as investors speculated on the potential end of the tightening monetary cycle. Despite the Federal Reserve’s warnings of a 50-basis point rate increase in 2023, the downbeat economic indicators prompted market participants to reassess the likelihood of such a move

The Dow is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 65, suggesting the index might extend its gains after successfully breakout since the RSI stays above the midline.

Resistance level: 34460.00, 35485.00

Support level: 32625.00, 31645.00

On Thursday, oil prices soared 3%, driven by two key factors. Firstly, China’s oil refinery throughput demonstrated remarkable growth, rising by 15.4% in May compared to the previous year, marking its second-highest level ever recorded. This strong performance in China’s refinery activity has instilled optimism in the oil market. Additionally, the weakening of the US dollar against a basket of other currencies, triggered by higher-than-expected jobless claims and an unexpected increase in retail sales, has further propelled the rise in oil prices. The dollar’s depreciation has made crude oil more attractively priced for holders of alternative currencies, stimulating oil demand and contributing to the upward momentum in prices.

Oil prices are currently trading near a crucial resistance level, which holds significant importance for market participants. If prices break above this level, it could trigger a bullish momentum and pave the way for further upward movement. However, given the significance of this resistance level, investors are advised to exercise caution and closely monitor price action before making any trading decisions, as a failure to breach the resistance could lead to a potential reversal or consolidation.

Resistance level: 70.70, 74.20

Support level: 67.20, 65.00

Traden Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Tradingbedingungen

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!