App herunterladen

-

- Handelsplattformen

- PU Prime App

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Web Trader

- PU Social

App herunterladen

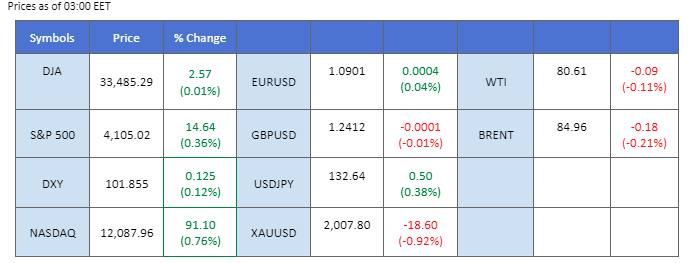

Last Friday, U.S. economic data gave mixed signals, leaving the markets clueless, especially on the upcoming Fed’s monetary policy. The Non-Farm Payroll decelerated to 236k but is in line with the market consensus. However, the country recorded a record low in the unemployment rate, showing that the labour market remains hot. Most asset classes were muted during the Easter holiday long weekend while the U.S. treasury yield slid slightly and the dollar index rebounded. In Japan, Kazuo Ueda has taken over the reins at the BoJ, starting his 1st 5-year term; despite no hints from him, economists expect some changes in BoJ’s monetary policy by June. Elsewhere, oil prices traded steadily at above $80 while the market is awaiting for OPEC and IEA monthly reports this week and gauging for oil prices’ future movement.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (34%) VS 25 bps (66%)

The Dollar Index stood firm during the early hours of Asian trading, buoyed by unexpectedly robust economic data that suggested the US jobs market remained resilient last month. This impressive showing has led to speculation that the Federal Reserve may raise interest rates in the coming months. Market participants are now pricing in a 70% chance of a 25-basis point rate hike after the bullish data were released. According to the Bureau of Labor Statistics, US Nonfarm Payrolls clocked in at 236K, a figure that was nearly in line with market expectations of 239,000. Notably, the unemployment rate fell to 3.5% from February’s 3.6%, outstripping market expectations.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 52, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 102.80, 103.40

Support level: 101.95, 100.85

Gold prices plummeted under the weight of unexpectedly strong US economic data. US Treasury yields experienced a rebound in response to the latest jobs numbers, which revealed a sustained demand for labour despite some indications of an economic slowdown. Following the release of the jobs report, interest-rate futures indicated a roughly 70% likelihood that the Federal Reserve would implement a 0.25 percentage point rate hike at its next meeting in May, according to data from CME Group.

Gold prices are trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 38, suggesting the commodity might extend its losses after successfully breakout since the RSI stays below the midline.

Resistance level: 2030.00, 2055.00

Support level: 2005.00, 1975.00

The pair recorded a flat session while most of the market celebrated the Easter holiday in the past weekend. The euro was suppressed at 1.0961 and hammered with the rebound of the U.S. dollar. Despite a slowdown in Non-farm Payroll, a recorded low unemployment rate in the U.S. conceived that the Fed may continue raising interest rates. The U.S. CPI and the FOMC meeting minutes are going to be released by this Wednesday. A high reading and Hawkish tone in the minutes may spur the dollar to trade higher and put further pressure on the euro to regain its strength against the dollar.

The indicators given a neutral signal for the pair have the volatility for the pair has been minimal. The RSI stays flat at near 50 and the MACD hovers close to the zero line.

Resistance level: 1.0917, 1.0965

Support level: 1.0867, 1.0796

The Japanese Yen suffered further losses on Friday as upbeat US economic data bolstered job outlook expectations in the United States, thus dampening demand for the safe-haven currency. The US-Japan yield divergence persisted, with US 10-year Treasury yields surging amid renewed expectations of rate hikes by the Federal Reserve. Adding to the mix, Kazuo Ueda is set to take over from Haruhiko Kuroda as the new Bank of Japan Governor on Monday. Market analysts widely expect Ueda to maintain the central bank’s massive stimulus program for the time being, as Japan’s economic recovery remains fragile. Ueda is scheduled to deliver his inauguration speech at 1:30pm GMT+3.

USD/JPY is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSi is at 63, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 132.75, 134.55

Support level: 130.60, 128.30

The pound fell by 0.32% to $1.2412 against the dollar on Friday as investors assessed the likelihood of the Federal Reserve increasing rates in its upcoming May decision. It caused the dollar to rise and prompted a drop in the pound’s value. Furthermore, Friday’s data did not provide a clear direction, plus today’s Easter Monday, trading volume for the pair is expected to remain low and trading in a narrow range. Most investors are awaiting crucial CPI data this week for further trading direction. Investors are suggested to trade cautiously in a low trading volume session.

Even a slight retracement in the prices, but the overall outlook for the pound remains stable. MACD remains above the zero line, which indicates diminishing bullish momentum. RSI is at 45, indicating a diminishing bullish momentum.

Resistance level: 1.2425, 1.2613

Support level: 1.2298, 1.2190

The Australian Dollar, a currency typically sensitive to risk appetite, suffered a blow on Friday as tensions between the United States and China over Taiwan escalated, denting the outlook for Australia’s crucial trading partner. The bearish momentum for AUD/USD was further fueled by the currency’s vulnerability to a strengthening US which continued to exert pressure on other currencies. Adding to the mix, the release of robust US Dollar jobs data sent shockwaves through the market, pushing up the odds of an interest rate hike by the Federal Reserve. In fact, the market is now pricing in a 70% probability of a 25-basis point rate hike, underscoring the buoyant mood surrounding the US economy.

AUD/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the pair might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 0.6725, 0.6785

Support level: 0.6655, 0.6595

Oil prices were up by 1.15% to $80.80 last Friday as traders continued digesting the announcement from the OPEC+. The recent announcement by OPEC+ to cut oil production has surprised the market and pushed crude prices up by the most in a year. Moreover, the prices were also supported by a bigger-than-expected drop in U.S. crude inventories last week and a second straight weekly decline. Gasoline and distillate inventories also fell, suggesting higher demand. Despite the recent drop in U.S. crude inventories, global oil stockpiles are still high, and investors are advised to trade cautiously and keep an eye on more economic data to be released for further trading signals.

Crude oil prices remain steady and hover near the resistance level of $81.06 as of writing. MACD has illustrated bullish momentum ahead. RSI is at 67, indicating the pair is trading in a strong momentum.

Resistance level: 81.06, 85.45

Support level: 77.25, 73.80

Traden Sie Forex, Indizes, Metalle und mehr zu branchenweit niedrigen Spreads und mit blitzschneller Ausführung.

Registrieren Sie sich für ein PU Prime Live-Konto mit unserem unkomplizierten Verfahren

Zahlen Sie bequem über verschiedene Kanäle und in verschiedenen Währungen auf Ihr Konto ein

Erhalten Sie Zugang zu Hunderten von Instrumenten zu marktführenden Tradingbedingungen

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!